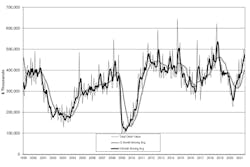

U.S. manufacturers and machine shops ordered $472.6 million worth of new capital equipment during July, -5.6% less than the June total but only the second decrease in monthly orders this year. The July result also represents a 41.5% increase over the July 2020 total, as manufacturers continue to invest in reaction to building industrial demand.

For the current year to-date, new orders for machine tools total $2.99 billion, which is 48.1% higher than the order volume for January-July 2020.

“The amplified pace of orders over the past several months has injected a degree of confidence into manufacturing not seen since before the pandemic,” commented Patrick McGibbon, chief knowledge officer for AMT– the Assn. for Manufacturing Technology. “Increased onshore capacity and diversified supply chains have made lead times more predictable and inventories more consistent, allowing manufacturers closer to end-use customers to justify the capital expenditures we are seeing in this month’s USMTO orders.”

AMT’s monthly U.S. Manufacturing Technology Orders Report is a forward-looking index to manufacturing activity, presenting actual data for capital investments in new machine tools. The total reflects machine shops and other manufacturers planning for future work orders – specifically, new orders of metal-cutting and metal-forming and -fabricating equipment.

The USMTO report includes data for new orders nationwide and in six geographic sectors, based on information supplied by participating producers and distributors of that equipment.“July is typically a soft month in any year, and despite the massive recovery we’re seeing, 2021 is no different,” McGibbon said of the current report. “The difference between 2021 and any other year is the scale of orders our members are reporting going into the late-summer slump. Through the first seven months of 2021, orders are just a fraction off the pace to become the (USMTO) program’s second-highest annual total.”

He noted that the supply-chain complications ongoing in automotive and aerospace sectors did not decrease July demand for new machine tools by their suppliers, but those sectors’ share of total orders declined because of the growing demand among other sectors’ suppliers. For example, new-orders rose in July among motor vehicle stamping, food processing, and agricultural equipment manufacturers.

The USMTO’s July regional results showed month-over-month growth in only one area of the country, the North Central-East, where new orders for metal-cutting equipment increased 12.8% from July to $110.92 million – though this figure is -5.5% lower than the July 2020 result. Through July 2021, the region has cumulative new orders of $743.45 million, a 47.8% year-to-date increase.

Monthly order totals for metal-cutting equipment fell less than 10% in the Northeast, Southeast, North Central-West, and West regions, and each of these regions has reported solid increase for the year-over-year and YTD tallies.

The South Central region reported July new orders for metal-cutting equipment totaling $30.26 million, a -24.5% fall-off from June but still 76.6% higher than July 2020, and raising the YTD regional total to $218.3 million, a 55.9% increase.