Supply Chain Delays Drag Cutting-Tool Orders

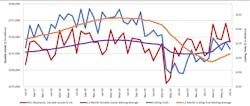

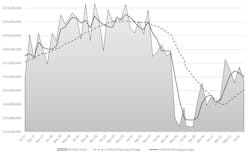

U.S. machine shops and other manufacturers consumed $162.3 million worth of cutting tools during July, -5.7% less than the June total and yet 25.5% higher than the July 2020 consumption level. The new figure also raises the 2021 year-to-date consumption total to $1.1 billion, 4.6% higher than the January-July 2020 total.

The figures are provided by the U.S. Cutting Tool Institute and AMT-the Assn. for Manufacturing Technology in the latest release of their monthly Cutting Tool Market Report.“The cutting tool industry continues to show year-over-year positive growth for 2021 from the low of the pandemic year,” noted Brad Lawton, chairman of AMT’s Cutting Tool Product Group. “However, the last few months have slowed for many reasons and have produced an up-and-down performance because of disruptions to the normal business conditions.

“Supply chain shortages, labor shortages, inflation, weather disruptions, and of course, the continuing COVID effects have all played a part in the roller-coaster ride,” Lawton detailed, “but in the end, the manufacturing industry shows the demand for growth, and the cutting tool industry is poised to respond.”

The CTMR presents real-time data on cutting-tool consumption supplied by a majority of the U.S. market for cutting tools. Because cutting tools are required in the production of a wide variety of parts and components supplied to a range of industrial sectors, cutting-tool consumption is taken as an index of current manufacturing activity, comparable to shipments of durable goods.“July’s cutting-tool report slipped to the negative compared to the previous month, probably due to supply chain disruptions and summer vacations,” according to Chris Kaiser, executive advisor to cutting-tool manufacturer BIG Kaiser. On the positive side, the 12-month average follows durable goods, which is increasing slowly and may get to pre-pandemic levels by the end of Q1 2022. If cutting tool consumption follows the machinery order trend, which it normally does with a two to five-month lag time, we should see better numbers by year-end and a good start to 2022.”