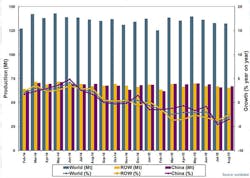

Raw steel production declined worldwide in August for the third consecutive month, though by less than 1% in the latest total. Steelmakers in 65 nations reporting to the World Steel Association produced 132.3 million metric tons in the month past, down 3.0% versus the August 2014 total, and bringing the year-to-date total to 1.08 billion metric tons, 2.3% less than the January-August 2014 total.

The declining level of raw steel production matches the World Steel Assn.’s short-range consumption output, issued in April, which pointed to recession in China, falling oil prices worldwide, and an uneven industrial recovery in the EU, among the factors depressing steel demand.

In its recent release, World Steel also reported global raw-steel capacity utilization at 68.0% during August, down 0.4% from July and down 3.6% compared to August 2014.

World Steel’s monthly report covers production and capacity utilization data for raw steel — the output of basic oxygen furnaces and electric arc furnaces, prior to alloying to specific grades and casting into semi-finished products, such as slabs, blooms, or billets. The results include data for carbon and carbon alloy steel output. Stainless steels and other specialty alloy steels are not included.

The 65 nations contributing data to the report represent approximately 98% of all steel produced worldwide.

The Chinese steel industry typically produces roughly half of all the world’s raw steel, and its August total of 66.9 million metric tons was 1.7% more than the July result. Even so, Chinese consumers reduced demand and the government’s efforts to rationalize excess capacity puts the August tonnage 3.5% behind the August 2014 total, and the China’s year-to-date tonnage down 2.1% from the eight-month total for last year.

Japanese steelmakers produced 8.8 million metric tons of raw steel during August, down 0.5% from July and down 5.8% compared to August 2014. The country’s year-to-date total is now 70.2 million metric tons, down 4.9% versus the same period of last year.

The Indian steel industry produced 60.5 million metric tons during August, virtually even with July, and 2.8% more than the August 2014 output. That emerging steel power has produced 60.5 million metric tons of steel thus far in 2015, 4.1% more than during January-August 2014.

In South Korea, August steel production was essentially unchanged from July, but the current result is 4.9% higher than the August 2014 total. Still, the year-to-date output of 46.4 million metric tons is 3.2% less than the eight-month total for last year.

In the European Union, Germany produced 3.4 million metric tons of raw steel during August, 5.0% less than during July but 10.7% more than during August 2014. The year-to-date total is 29.2 million metric tons, just 0.5% more than the comparable figure for 2014.

France’s production for August 2015 was just 1.04 million metric tons, 13.8% less than during July, and 1.5% less than during August 2014. The eight-month result is 10.4 million metric tons, 3.6% less than the comparable figure for last year.

In Italy last month, steelmakers’ output reached 998,000 metric tons, their lowest total for the current year and 48.2% less than in July — an apparent case of scheduled downtime. The year-to-year comparison had the Italian industry up 1.3% versus last August. The year-to-date result has them at 14.6 million metric tons for the current year, down 9.5% compared to eight months of 2014 output.

Turkey’s steel industry produced 2.6 million metric tons during August, 1.1% more than during July but 11.8% less than during August 2014. For the January-August period, Turkish steelmakers are 7.0% behind the pace set last year.

In August 2015, Russian steelmakers produced 6.0 million metric tons of raw steel, 0.5% less than during July and 3.2 less than during August 2014. Their eight-month output is 47.8 million metric tons, or 0.2% less than last year by comparison.

Ukrainian producers had an August output of 1.9 million metric tons of raw steel, 2.7% more than during July and 8.6% compared to the same month in 2014. That nation remains gripped by war, however, and the year-to-date steel output is 23.6% less than at this point in 2014.

Brazil’s raw steel production declined 2.7% from July to August, to 2.8 million metric tons, which is down 5.4% compared to August 2014. At 22.75 million metric tons, Brazil’s current total is just 0.3% higher than last year’s eight-month record.

Finally, August raw steel production in the U.S. was 7.0 million metric tons (7.7 million short tons), which was 0.5% less than July and 9.7% less than during August 2014. Through eight months of the current year, U.S. raw steel production stood at 54.01 million metric tons (59.5 million short tons), which is 8.5% less than the January-August 2014 total.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.