Machine Tools Orders Trending Upward

U.S. manufacturers’ orders for new machining equipment slipped to $444.9 million in April, down -12.7% from March. However, as noted by AMT - the Assn. for Manufacturing Technology, the new figure is 44.5% higher than the April 2024 total, and it raises the new order total for January-April 2025 to $1.69 billion, or 17.8% higher than last year’s four-month tally.

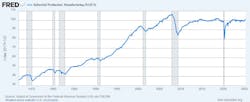

Those figures support AMT’s reading of rising demand for machine tools since the end of Q3 2024.

“Despite declines in overall manufacturing output, machinery manufacturers increased production by 0.3% in April, continuing the upward trend that began in October 2024,” AMT stated, pointing to Federal Reserve Bank data on durable goods production.

Further to the point, AMT explained that machine tool orders typically fall from March to April, as the March totals include orders reported by various machine builders as closing out their activity for the fiscal year. Also, it noted that that decrease in order values from March to April 2025 represents the smallest drop over that period since March-April 2022.

AMT’s monthly U.S. Manufacturing Technology Orders report is a summary of capital equipment purchases, reported according to order value and machine units, nationwide and in six regions. It serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

Some portion of the current demand for machine tools may represent buyers’ efforts to out-run the anticipated tariffs on imported goods, AMT observed.

Contract machine shops’ April orders declined by -6.3% from March, less than half the overall rate of decrease during that period.

On the other hand, machine-tool orders from the aerospace sector dropped by nearly half from March – and still remained higher than their 2024 monthly average.

Monthly region-by-region demand for machine tools showed improvement only in the Sout Central territory, where the order total increase 22.2% from March to April.

In contrast, the year-over-year USMTO order values increased in every region except one, the Southeast, where the April 2025 total is down -2.3% from last year.