More Improvement in US Machine Tool Orders

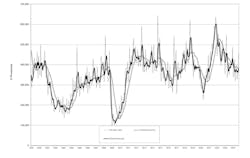

Strong demand by U.S. contract machine shops drove the value of new orders for CNC machines to $450.6 million during September, according to AMT - the Assn. for Manufacturing Technology. The result is a 24.0% rise over the August order total and 14.6% over September 2023.

The September result brought 2024 year-to-date new order volume to $3.35 billion, which is still -7.7% lower than the nine-month total for 2023.

A more significant lag was reported recently by VDW, the German Machine Tool Builders Assn.

For AMT, the September update of its U.S. Manufacturing Technology Orders report showed 2024’s highest monthly level of demand for CNC machinery, and 5.1% higher than the average September order volume. The report period coincided with IMTS 2024, the biannual International Manufacturing Technology Show. “While this may be a good sign for an industry looking to find bottom after nearly three years of decline, the optimism comes with a major caveat, as orders were 9.1% lower than in an average IMTS September,” according to AMT’s release.

The USMTO is a monthly summary of purchases of metal-cutting machinery and metal-forming and fabricating machinery nationwide, and in six regions. USMTO also serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

The September USMTO report showed particularly strong order volumes for metal cutting machines in the North Central-East ($117.93 million), Northeast ($86.77 million), and North Central-West ($84.74 million.)

The contract machine shops (often called “job shops”) are the largest market segment for CNC machines, and their September demand level was the highest recorded since March 2023. AMT noted that these shops are a bellwether for the industry as a whole, “as sudden demand from this segment indicates that OEMs are increasing orders from them to meet additional needs on capacity.

“This demand, if it remains elevated, would typically lead to later investments across customer industries,” the association added.

Demand from aerospace manufacturers declined by nearly a third from August, apparently as a result of the strike by Boeing machinists during September, and this is likely to continue into the October USMTO report.

Automotive sector demand improved in September, with automotive transmissions manufacturers turning in their highest volume of orders since August 2023.

“Through most of 2024, manufacturers hesitated to invest in manufacturing technology due to concerns over heightened interest rates and November’s U.S. presidential election,” AMT detailed. Further developments related to Federal Reserve Bank rate cuts in September and the conclusion of the election may be reflected in further increases in demand during the remainder of 2024.