Another Big Drop in Machine Tool Orders

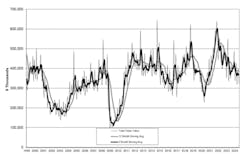

Machine tool orders fell sharply from June to July, down -19.3% to $321.7 million in the latest summary by AMT - the Assn. for Manufacturing Technology. While July is a typically a slow period for new orders, AMT’s new U.S. Manufacturing Technology Orders report showed purchasing activity also trailed the July 2023 level by -7.8%, and that with orders totaling $2.53 billion year-to-date, January-July 2024 is -10.5 behind last year’s comparable figure.

Adding to the poor results, AMT noted that order cancellations during July were at the highest level since July 2023, and the ratio of cancellations to new orders remained above the historical average in all but two months of this year.

The USMTO is a monthly review of new orders for machine tools (i.e., “manufacturing technology”), that serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs.

AMT’s report compiles data for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

While the USMTO is a forward-looking index, throughout 2024 new-order totals have failed to validate various economists’ estimates of “soft landing”, when inflation would ease and economic activity will gain momentum. That possibility remains, but it has not been shown by machine-tool order volumes.

During July, all the regional order volumes reconfirmed the general decline, and in five of the regions those were double-digit percentage drops. Only the North Central-East (-5.0% decrease in orders for metal-cutting machines) managed to contain the June-to-July losses, but the year-to-date declines are all in the double-digit percentages.

Even so, AMT located some positive indicators from the July activity, including the detail that contract machine shops’ orders fell by less than 5% from June to July. Those operations, frequently called “job shops,” comprise the largest buying segment for the industry, and the number of units they ordered rose nearly 10% month-over-month. “This indicates that shops are beginning to expand capacity in anticipation of their customers placing additional orders for parts,” AMT noted.

July order activity by the medical equipment manufacturing segment increased from June to July, but the number of new machines order fell – presumably an effect of demand for higher-value, high-precision products, which may be seen as a long-term growth factor.

AMT also noted that orders from manufacturers of electrical generation and distribution equipment were unchanged during the month, but stood out as a larger share of the total order volume as a result of the overall lower order level.