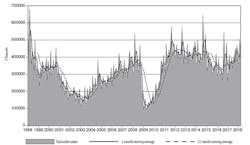

Domestic manufacturers ordered $392.97 million worth of machine tools during April, 22.6% less than during March and yet 10.5% more than the April 2017 total. The year-to-date total for new orders increased to $1.64 billion, 22.2% higher than last year’s January-April new-order total.

The figures are drawn from the monthly U.S. Manufacturing Technology Orders Report, released by AMT – the Association for Manufacturing Technology, and based on new machine-tool (manufacturing technology) data supplied by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment. The results are based on actual order totals, nationwide and in six regional markets.

“April’s fall relative to March isn’t a surprise,” according to AMT president Douglas K. Woods. “With many companies ending their fiscal year in March, a push for new equipment investment supercharged the end of the first quarter, which has left April short of March levels for the past 20 years.

“The remainder of the year is set up for a strong finish. The indicators consistently point to continued expansion of the manufacturing sector," Woods emphasized.

The latest forecast from CECIMO, the European machine-tool manufacturers consortium, offered a similar demand forecast for 2018.US Machine Tool Orders Up 26% in Q1

The April USMTO report shows that demand slipped across all regions of the coverage. In the Northeast, new orders for metal-cutting equipment declined 7.0% from March to $73.33 million during April. The latest figure represents a 44.1% improvement over the April 2017 total, and brings the regional year-to-date total for metal-cutting equipment orders to $286.6 million, 25.5% higher than last year’s January-April order total.

In the Southeast, April’s new orders for metal-cutting equipment totaled just $38.26 million, a decline of 36.1% from March, and of 5.3% from April 2017. The regional year-to-date new-order total for metal-cutting equipment is $164.0 million 7.0% higher than the total for the comparable period of 2017.

The North Central-East region reported new orders for metal-cutting equipment at $93.94 million, down 7.0% from March but up 10.3% higher than the April 2017 result. For the January-to-April period, the regional total for metal-cutting equipment new orders was $355.8 million, a rise of 13.6% versus last year’s four-month result.

In the North Central-West region, new orders for metal-cutting equipment totaled $73.37 million, down 26.0% from March but up 41.4% from April 2017. The year-to-date result for metal-cutting equipment in the region is $298.44 million, an increase over 43.4% over last year’s figure.

New orders for metal-cutting equipment in the South Central region declined to $29.44 million during April, a drop of 43.7% from March and of 29.9% from April 2017. The regional total for YTD new orders is $170.75 million, up 34.3% over the last year’s comparable result.

Finally, in the West region new orders for metal-cutting equipment totaled $70.27 million during April, down 31.8% from March and down 10.5% from April 2017. For the January-April period, the West region’s new orders for metal-cutting equipment total $296.5 million, a 14.7% improvement over last year’s figure.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.