September Steel Output Shows Global Industry Still Adjusting

Global raw steel output declined slightly from August to September, and the year-to-date total remains slightly behind the 2015, and yet the September year-over-year output rose slightly more than 2.0% as the world’s major steelmakers continue to try adjusting to weak demand and excess supplies. The results are drawn from date released by the World Steel Assn., which tracks monthly raw-steel output and capacity utilization rates for 66 countries.

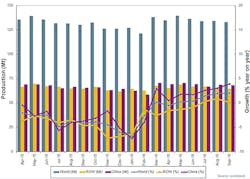

Worldwide, raw steel production totaled 132.9 million metric tons during September, a decline of 0.91% from August but an increase of 2.02% versus the September 2015 production total.

For the year to date, the world’s steelmakers have produced 1.197 billion metric tons of raw steel, nearly even (-0.49%) of the total produced during the comparable (January-September) period of 2015.

Raw-steel capacity utilization for the 66 countries was 70% in September, just 1.5% higher than during August. In September 2015, the capacity utilization rate was 69.5%.

Raw (or crude) steel is the output of basic oxygen furnaces and electric arc furnaces that is cast into semi-finished products, such as slabs, blooms, or billets. The World Steel Association reports tonnage and capacity utilization data for carbon and carbon alloy steel in 66 countries; data for production of stainless and specialty alloy steels are not included.

Global steel output has been falling at a steady pace for much of the past two years. Earlier this month, World Steel Assn. issued a semi-annual Short Range Outlook report for global steel demand, projecting a total 2016 increase of 0.2% to 1.501 billion metric tons, after a 3.0% decline in 2015. For 2017, the Outlook is for a 0.5% increase, to 1.51 billion metric tons.

Much of the declining output is accounted for by Chinese producers trimming excess and outdated production capacity –in line with Chinese regulators’ long-range directives. However, the September report shows that the centralized efforts may not be proceeding as smoothly as the regulators or the wider world’s steelmakers may wish.

During September, China’s steelmakers produced 68.2 million metric tons of raw steel, less than 1% below the August total but 3.9% higher than the September 2015 output level. Through nine months of the current year, the Chinese industry has produced 603.9 million metric tons, which is 0.47% more than during the comparable period of 2015.

In Japan, September raw steel output fell 5.24% from August and 1.5% from September 2015, to 8.4 million metric tons. Japan’s January-September output of 78.4 million metric tons represents a 0.54% decline compared to the nine-month output total for 2015.

India’s steelmakers produced an estimated 7.9 million metric tons during September, 3.21% less than during August but 8.48% more than during September 2015. The Indian year-to-date steel output is 71.1 million metric tons, 5.9% higher than last year’s nine-month total.

South Korea’s raw-steel production during September was 5.7 million metric tons, down 2.5% from August but up by 1.1% over September 2015. The Korean year-to-date steel output is 50.95 million metric tons, 1.8% lower than last year’s January-September total.

In Europe, the 28 nations of the European Union produced 13.26 million metric tons of raw steel during September, 10.86% more than during August, but 1.7% less than last September. For the January-September 2016 period, the EU’s raw-steel output is 121.3 million metric tons, 4.8% less than last year’s first nine months.

Europe and Beyond

Germany has the largest steel industry in the EU, and one of the largest in the world. During September, German steelmakers’ output was 3.25 million metric tons, 7.6% less than during August and 3.9% less than during September 2015. The year-to-date output in Germany is 32.0 million metric tons, 1.7% less than during the same period of last year.

Steelmakers in Italy produced 1.99 million metric tons during September, 84.5% more than during August (a traditional vacation period), but 5.26% less than during September 2015. The January-September 2016 production total is now 17.3 million metric tons, 3.3% more than last year’s nine-month result.

In France, the September raw-steel output was 1.3 million metric tons, 30.0% more than the August figure and 2.2% more than the September 2015 figure. Still, year-to-date raw-steel production in France is 8.9% below the January-September 2015 total.

Spanish steelmakers produced an estimated 1.2 million metric tons during September, a total that is 10.1% higher than the August figure but 8.7% less than the September 2015 total. The nine-month total for Spanish steelmaking output is 10.6 million metric tons, 6.8% lower than the comparable 2015 figure.

In Turkey, raw-steel production totaled 2.65 million metric tons during September, 5.5% less than during August but 8.15% more than during September 2015. Year-to-date, Turkey’s steelmakers have produced 24.4 million metric tons of raw steel, 4.13% more than the comparable 2015 output.

Steelmakers in Russia produced 5.7 million metric tons during September, 2.5% less than during August and 2.1% less than during September 2015. The January-September raw-steel output in Russia is 52.7 million tons, which is 1.7% less than last year

The Ukrainian steel industry had a September raw-steel production output of 1.9 million metric tons, 1.1% less than the August figure and 8.0% less than the September 2015 result. For the first nine months of this year, steelmakers in Ukraine have produced 18.3 million metric tons, 6.9% more than during the same period of 2015.

Brazil’s steel industry produced 2.6 million metric tons during September, or 6.8% less than during August and 3.1% more than during September 2015. The year-to-date raw-steel output for Brazil is 22.9 million metric tons, down 9.3% versus last January-September.

Finally, steelmakers in the United States produced 6.3 million metric tons (6.9 million short tons) of raw steel during September, 5.12% less than their August output, and 3.8% less than their September 2015 output. From January through September, U.S. steelmakers have produced 59.7 million metric tons (65.8 million short tons), 1.3% less than during the comparable nine-month period of 2015.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.