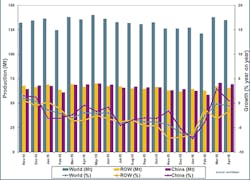

Raw steel production declined to 135 million metric tons worldwide during April, down 1.76% from the March total and 0.43% less than the result for April 2015. For the first four months of this year, global steel tonnage is up to 521.3 million metric tons, which 2.46% less than the total tonnage for January-April 2015.

The figures are supplied by the World Steel Association and represent the total for raw steel production in its 66 member nations. The Brussels-based World Steel Assn. tracks raw (or ‘crude’) steel production and capacity utilization on a monthly basis.

Raw steel is the output of basic oxygen furnaces and electric arc furnaces that is cast into semi-finished products, such as slabs, blooms, or billets. The Association reports tonnage and capacity utilization data for carbon and carbon alloy steel; data for production of stainless and specialty alloy steels are not included.

During April, raw steel capacity utilization was 71.5% for the 66 countries — 0.8% higher than during March and 1.3% lower than April 2015. (Editor’s note: These figures are revised from the initial release issued by World Steel.)

The production totals generally confirm the recent forecast issued by World Steel, indicating declining demand worldwide for 2016. That study global steel demand will decline by 0.8% this year to an estimated 1.488 billion metric tons, following the 3.0% annual decline shown in the 2015 global steel production (1.62 billion metric tons.)

China remains the world’s largest steelmaking nation, and during April Chinese raw steel production declined by 1.7% from March to April 2016, ending month at 69.4 million metric tons. It was a scant 0.74% increase compared to the April 2015 result and brings the year-to-date total for China to 262.43 million metric tons, 1.33% less than the January-April 2015 total.

Japan’s industry produced 8.5 million metric tons of raw steel during April, 1.74% less than during March, and an increase of 1.15% compared to April 2015. The four-month total for the current year is 34.35 million metric tons, or 2.27% less than last year’s comparable total.

In India, April raw steel production fell 3.21% from March to 7.8 million metric tons, though that figure is up 3.89% higher than April 2015, and the nation’s year-to-date production total is now 30.7 million metric tons, 2.34% higher than during the first quarter of April 2015.

South Korean steelmakers produced 5.7 million metric tons of raw steel during April 2016, just 0.8% less than during March and 1.3 less than during April 2015. January-April total tonnage is 22.125 million metric tons, 2.33% less than last year’s four-month result.

Across the European Union (28 nations), raw steel production decreased 4.47% from March, ending the month at 13.49 million metric tons. That figure represented a 5.21% decline from April 2015, and the four-month total for the EU is now 54.43 million, down 6.51% from 2015’s four-month total.

In Germany, the EU’s largest steel-producing nation, April raw steel production declined 6.7% from March to 3.6 million metric tons, which is 1.5% less than the April 2015 result. German year-to-date production is now 14.34 million metric tons, 2.27% less than last year’s Q1 total.

Italian steelmakers produced 2.1 million metric tons of raw steel during April, 3.26% more than during March and 14.46% more than during April 2015. The January-April total is 7.89 million metric tons, 1.09% more than the comparable 2015 total.

Raw steel output by Spain’s producers declined 2.93% from March to April, settling at 1.2 million metric tons, and that figure is down by 10.6% compared to April 2015. The four-month total for the Spanish steel industry is 4.77 million metric tons, 8.28% less than during the same period of last year.

In France, April raw steel production declined 14.4% from March, to 966,000 metric tons, and that result is down 26.45% from the year-ago April tonnage. Year-to-date, the total of 4.74 million is 11.12% off-the 2015 pace.

The Turkish steel industry produced 2.9 million metric tons during April, 5.79% more than during Mach and 5.3% more than during April 2015. During the first four months of this year, Turkish steelmakers produced 10.58 million metric tons, 2.83% more than last year’s comparable figure.

In April, Russia’s steel industry produced 5.9 million metric tons of raw steel, 2.0% less than during March and 0.4% less during April 2015. The nation’s year-to-date total is 23.14 million metric tons, 3.9% less than last year’s four-month total.

Steelmakers in Ukraine produced 2.2 million metric tons of raw steel during April, just 0.9% less than during March but 11.7% more than the April 2015 total. The January-April total is 8.27 million metric tons, 16.8% more than last year’s four-month figure.

Brazilian steelmakers’ raw steel production for April 2016 was 2.3 million metric tons, 8.23% less than the March figure and 20.6% less than the April 2015 tonnage. The first-quarter total is 9.74 million metric tons, which is 14.05% less than the tonnage for the same period of 2015.

Steelmakers in the United States produced 6.6 million metric tons (7.27 million short tons) of raw steel during April 2016, 2.62% less than during March and 2.5% more than during April 2015. The year-to-date raw steel production for the U.S. industry is 26.22 million metric tons (28.9 million short tons) an increase of 2.5% compared to April 2015.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.