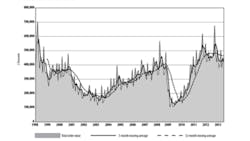

U.S. manufacturers ordered $426.83 million worth of new machine tools and related equipment during June, a 5.8% drop from the May total, and a 5.7% decrease from the June 2012 result. The data is contained in the monthly U.S. Manufacturing Technology Orders report, compiled by AMT - the Association for Manufacturing Technology and based on actual data reported by participating companies.

The USMTO report includes data on production and distribution of machine tools and related equipment, including domestic products as well as imports. In addition to the U.S. total, the report provides results for six geographic regions.

The June result brings the U.S. year-to-date total for manufacturing technology orders to $2,538.55 million, a decline of 5.7% compared with the January-June 2012 total.

“It’s typical for orders to experience a modest drop going into the summer months, and we’ve seen this lull in six of the past nine summers,” observed AMT president Douglas K. Woods. “It’s important to remember that in the overall picture, this is a very strong order level.

“Manufacturing is still the key area driving the economy,” Woods continued. “With durable goods orders at a record level of $244 billion in June, and the Purchasing Managers’ Index at 55, we expect manufacturing technology orders to hold steady through the end of the year.”

The manufacturing technology totals for June showed modest improvement for the month in two of the six regional markets, and marked declines in two others.

• In the Northeast, June manufacturing technology orders dropped 21.8% to $66.29 million, compared to May’s total of $84.80 million. The new total represents a 3.5% decline from the June 2012 total.

With a year-to-date total of $403.45 million, Northeast manufacturing technology orders are up 1.3% compared with the totals for the first six months of 2012.

• In the Southeast region, manufacturing technology orders rose 12.2% from May to June from $44.36 million to $49.75 million. It was the best rate of improvement for June in any of the six regions in the USMTO report. The newer figure represents a 24.0% drop from the June 2012 result.

With a six-month total of $233.75 million, the year-to-date result for the Southeast region is 15.0% lower than for January-June 2012.

Highest Value for June

• The North Central-East delivered the highest-value result for June, $112.90 million, a 9.3% improvement over the May total of $103.32 million. The June figure represents 6.0% increase over the June 2012 total.

The region’s six-month 2013 total is $654.66 million, down 6.0% compared to the region’s January-June 2012 result.

• The North Central-West region delivered machine tool orders totaling $78.13 million in June, up just 0.9% from $77.45 million recorded for May. But, the total now is down 6.5% compared with the June 2012 results.

The January-June regional total stands at $489.65 million, down 0.6% from the comparable figure for 2012.

• The South Central region’s June 2013 manufacturing technology orders totaled $62.86 million, a decline of 3.6% compared with the May total, $65.23 million, and down 15.7% compared with the June 2012 result.

The region has a year-to-date total of $383.01 million, a decline of 22.6% versus the region’s January-June 2012 total.

• Finally, in the West region, manufacturing technology orders fell 27.2% during June, to $56.91 million from $78.15 million during May. That new figure represents an increase of 5.7% over the June 2012 result.

The West region now has a year-to-date total of $374.03 million, 11.7% more compared t January-June 2012 total.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.