New Lows Recorded in Machine Tool Orders

The largest constituency in the market for manufacturing technology are contract machine shops, often called job shops, which are independent businesses offering machining services to a range of OEMs and other manufacturers. AMT noted that in January these contract machine shops cut their new order total to the lowest level since July 2023, and -27.1% below the December 2023 result. “These shops have been ordering below their typical share for some time now,” according to AMT. “Should business conditions improve for these manufacturers, there is a large upside potential for future orders of manufacturing technology.”

In contrast to those contract machine shops, large manufacturing businesses and OEMs have increased their new order totals “at a pace that has nearly offset the decline in orders from contract machine shops,” according to AMT. This includes orders from manufacturers of machinery for extracting and refining oil and natural gas, which may indicate future capacity expansion and modernization plans in that sector.

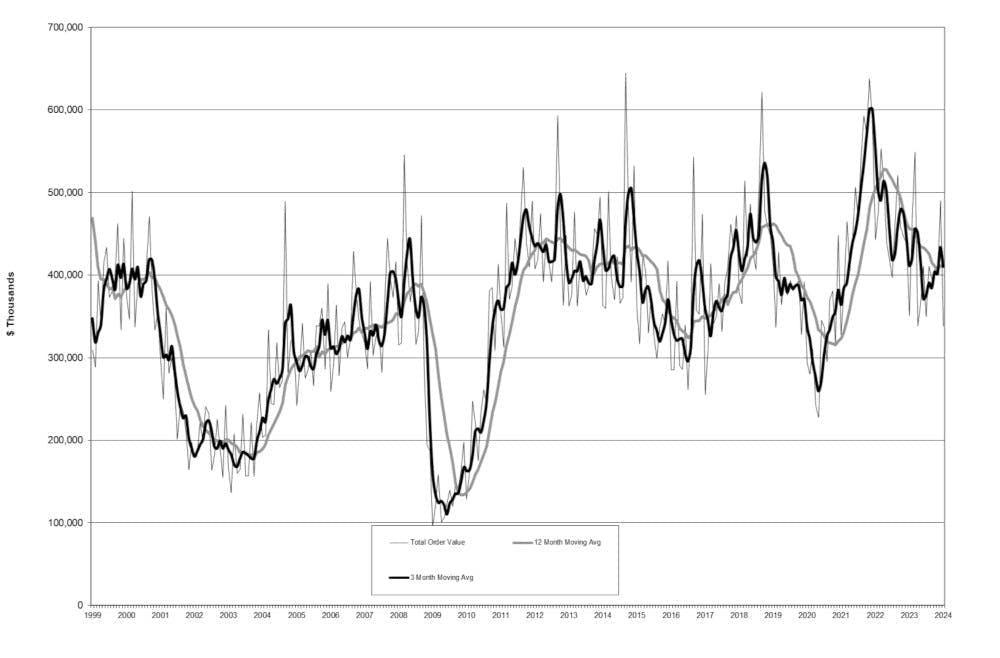

U.S. manufacturers orders for machine tools and similar capital equipment dropped -31.0% from December 2023 to $338 million in January 2024. It represents a -3.7% decrease from the January 2023 total.

While January order values are typically the lowest in a given year, the current results represents the lowest January order value since 2021, and the lowest January figure for units ordered since 2016. “This indicates the demand for manufacturing technology is still being driven by orders of highly specialized, automated machinery,” observed AMT – the Assn. for Manufacturing Technology in its latest U.S. Manufacturing Technology Orders Report.

AMT’s USMTO program tracks new orders of machine tools as an indicator of future manufacturing activity, as machining operations prepare to undertake new production programs. The monthly update compiles data for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

All of the January results for regional order totals reflect the overall decline.