Cutting Tool Orders Remain Stable in Q4

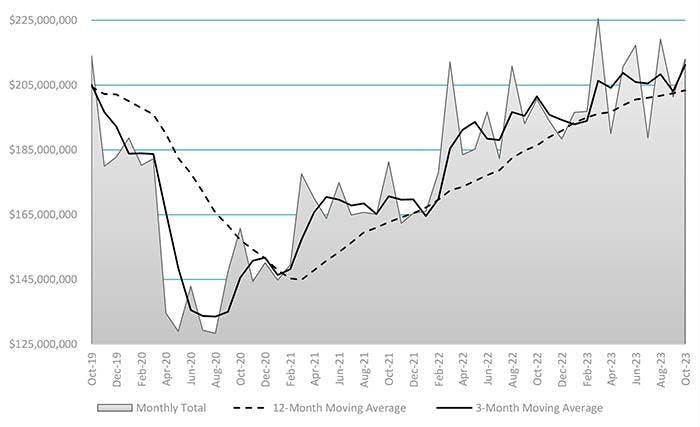

Domestic manufacturers purchased $213 million worth of cutting tools during October, 5.8% more than the amount purchased during September, and 6.1% more than the October 2022 total. Cutting tool consumption is indicative of overall manufacturing activity, as those purchases reflect activity across a range of manufacturing market segments served by machining operations.

According to the monthly Cutting Tool Market Report - compiled as a collaborative effort by the U.S. Cutting Tool Institute (USCTI) and AMT – the Association For Manufacturing Technology - U.S. machine shops and other operations have consumed $2.06 million worth of cutting tools during the first 10 months of 2023, 7.9% more than during January-October 2022.

“U.S. cutting tool orders continued to show a trend of uneven growth over the last quarter, and we expect that narrative to continue through the first half of next year,” observed USCTI president Steve Boyer.

Boyer continued: “Aerospace and automotive market indicators show sustained growth for 2024 and 2025. Other industrial market segments have softened over the last six months, and we anticipate some decline into the next year. Labor shortages, retention challenges, and an aging workforce will challenge future growth in our markets.”

Although current manufacturing support fairly strong demand for cutting tools, the USCTI/AMT release quoted economic forecaster Eli Lustgarten to advise caution: “With the unknown impact of current global turmoil and manufacturing inventories at normal levels or higher, customer orders are being delayed, and companies are focusing on right-sizing inventories. Sustaining current production levels, near-term, will be difficult.

“We expect cutting tool orders to remain firm, with 2023 orders of about $2.4 billion to $2.45 billion, likely about 6% to 7% above last year’s level,” according to Lustgarten. “The first half of 2024 will likely be challenging; a soft economic landing with lower rates will help stabilize and enhance growth next year. The wild card is international turmoil.”