No Sign of Rebound in Machine Tool Orders, VDW Reports

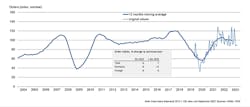

German machine-tool builders’ new orders fell by -9.0% year-over-year during the third quarter of 2023, according to the German Machine Tool Builders' Assn. (VDW), and the new-order total is down -7.0% during the first nine months of 2023. The order volumes from German customers have been only slightly stronger than from abroad for VDW members – who comprise one of the largest cohorts that country’s mechanical engineering sector. Germany also has the third-largest machine-tool manufacturing industry in the world, with 64% of its products exported to markets in Europe and worldwide.

"There is still no sign of a turnaround in incoming orders in the German machine tool industry," commented Dr. Wilfried Schäfer, exec. director of VDW.

The falling order volume is comparable to the trend reported for U.S. machine-tool demand. Through August, according to AMT - the Assn. for Manufacturing Technology’s U.S. Manufacturing Technology Orders report, 2023 U.S. machine tool orders are down -12.6% compared to the same period of 2022.

VDW blamed the decrease in orders on the familiar complex of issues undermining manufacturing activity around the world: low levels of capital investment; high interest and inflation rates slowing new investment, in Germany and Europe; consumer demand focused on services over durable goods; and a decline in inventory levels following an extended period of supply bottlenecks.

For the German machine-tool builders, foreign orders from Europe and Asia have been declining in 2023, with Chinese demand showing particular weakness.

VDW noted that its members’ machine-tool orders from the U.S. are outpacing their Chinese orders.

"The large backlog of orders is once again carrying us through these difficult times," stated Schäfer.

VDW member’s revenues are up 14.0% for Q3, the group reported, although the rate of increase is leveling, and capacity utilization rates fell from 90.5% in July to 88.5% in October.

"Under these circumstances, we can reconfirm our production forecast of 10% growth in the current year," according to Schäfer.

VDW also cautioned that the prospects for 2024 “are characterized by great uncertainty.”