Machine Tool Orders Down Nearly 40%

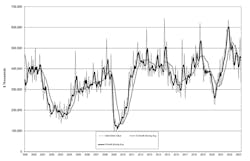

U.S. machine shops and manufacturers’ new orders for machine tools fell -38.7% from March to April, totaling $336.7 million in the latest monthly U.S. Manufacturing Technology Orders report. That figure also represents a -34.4% drop from last April’s total, and brings year-to-date manufacturing technology orders to $1.72 billion, a -13.6% decrease from the January-April 2022 total.

The USMTO is a monthly report by AMT – the Association for Manufacturing Technology, summarizing nationwide and regional demand for metal-cutting and metal-forming and -fabricating machinery. It is a forward-looking indicator of overall manufacturing activity, as machine shops and other manufacturers make capital investments in preparation for demand expected in the weeks and months ahead.

“March has traditionally been one of the better months for manufacturing technology orders, so April is typically a ‘down month’; however, this April was disproportionately off,” stated AMT president Douglas K. Woods. “March 2023 was only 2% down from March in the previous year, yet the decline between March and April in 2023 was over five times larger than the decline in 2022. The momentum of order activity is clearly not as strong through the second quarter as it was last year.”AMT detailed that new orders from job shops fell almost -39% from March to April, which was the largest month-to-month drop in orders from that group over six years, since January 2017. Automotive machine shops’ orders also fell significantly, it noted.

The reports’ regional results showed similarly large month-to-month declines in new orders. In the Northeast, April new orders for metal-cutting machinery fell -50.3% from March to $49.33 million; in the Southeast, new orders for metal-cutting machinery were down -46.4% from March to $38.54 million.

In the North Central-East region, new orders for metal-cutting machines fell -45.9% from March to $77.87 million, and in the North Central-West region the comparable new orders totaled $69.67 million, a -36.3% month-to-month decline.

The South Central region reported comparatively better metal-cutting machine new-order totals, $41.9 million for April, down -3.1% from March. Still, in the West region the $52.25 million in new orders for metal-cutting machines represents a -30.6% monthly decrease.

Addressing the general decline in order activity from March to April, Woods offered: “Consistently high interest rates, ongoing inflation, and the looming threat of a recession have caused businesses to rethink their capital investment strategies. Job shops, which are the largest consumers of manufacturing technology, are mostly small and medium-sized businesses who are particularly affected by price and interest rate pressures.

“In addition to USTMO, several other industry metrics compiled by AMT are showing a slowdown in activity relative to March,” he continued. “Regardless of what the Federal Reserve does with interest rates later this week, their outlook on economic activity, coupled with the May USMTO numbers available shortly after, should give a good indication of how hot or cool the summer will be for the manufacturing technology industry.”