Cutting Tool Demand Flattens as Uncertainty Lingers

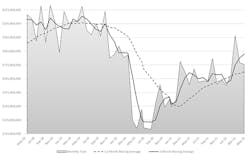

U.S. machine shops and other manufacturers’ consumption of cutting tools totaled $175.4 million during May 2022, only slightly (-0.6%) less than the April consumption total and 9.1% higher than the May 2021 total. AMT’s Cutting Tool Product Group chairman Brad Lawton offered that “‘uncertainty’ will remain with us for an extended period of time,” recognizing that manufacturing programs are maintaining a credible rate of activity against multiple complicating factors.

“The May numbers are very similar to April and seem to send the same message: that manufacturing continues to struggle with the issues of inflation, the supply-chain disruptions, and the shortage of human resources,” according to Lawton.Through five months of activity, U.S. cutting tool consumption stands at $875.8 million, which is a comparable 9.1% higher than the total for the same January-May period of 2021.

Cutting tool consumption is a reliable indicator of overall manufacturing activity, because cutting tools are a primary consumable across multiple industrial sectors, and all the figures are supplied by AMT – the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute in their monthly Cutting Tool Market Report. The CTMR data is reported by participating companies that represent the majority of the U.S. market for cutting tools.

Like AMT’s recently released U.S. Manufacturing Technology Orders report for May, the latest CTMR figures portray a well-performing, but not growing, manufacturing sector.Pat McGibbon, AMT’s chief knowledge officer, acknowledged that the sector is in line for a “seasonal softening in July and August,” before resuming growth in the final months of 2022. He pointed to leading indicators of manufacturing activity that suggest the market will continue to perform at a high rate. “Manufacturing capacity utilization remains over 80%, and the Institute for Supply Management’s PMI index is at 53,” according to McGibbon, “both of which signal continued expansion in the manufacturing sector.”

He continued: “Growing backlogs and delivery rates of manufacturing technology equipment will yield a significant expansion in manufacturing capacity. This surge in production capacity will support continued growth in cutting tool shipments through early 2023.”