New Machine Tool Orders Topped $650 Million

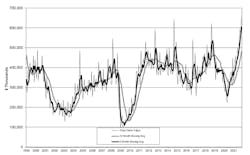

U.S. orders for new machine tools rose 13.8% from October to $650.05 million in November 2021, more than double (+111.3%) the November 2020 total, according to the latest U.S. Manufacturing Technology Orders Report released by AMT – the Assn. for Manufacturing Technology. AMT reported it to be the second-highest monthly total in the long-running USMTO series. The rise in activity continues a steady recovery in machine-tool demand throughout 2021, not only rebounding from the break in activity due to the Covid-19 pandemic but also supply-chain delays and skilled-labor shortages.

Through 11 months of new orders for 2021, the USMTO total stands at $5.315 billion, a $57.8% increase over comparable 2020 results.

The monthly USMTO report summarizes nationwide and regional data of new orders for metal-cutting and metal-forming and -fabricating machinery – presented in actual dollar values – and serves as a forward-looking indicator of overall manufacturing activity, as machine shops and other manufacturers make capital investments in preparation for demand expected in the weeks and months ahead.

“November orders illustrate continued recovery despite ongoing challenges brought on by the pandemic,” according to AMT president Douglas K. Woods.Woods cited tool and diemaking and valve manufacturing among several examples of manufacturing segments that are rebounding thanks to reshoring activity. “Job shops showed a modest decline in dollars spent but a double-digit increase in orders, indicating an industry-wide need for increased capacity,” he added.

AMT also noted the rising volume of new orders from manufacturers suppling aerospace and off-road (agricultural, mining, and construction) equipment production – complex and customized products that often are “dependent on financing and sensitive to interest rates,” Woods noted, as proof of significant and widespread industrial demand.

“Manufacturers have learned that supply chain disruptions and labor shortages are part of the landscape and are developing short and long-term strategies to address these challenges,” he said.

Each of the regions covered by the USMTO report indicated positive results for November, with double-digit month-to-month increases in the order values for metal-cutting machinery in the Northeast (+27.4%), Southeast (+25.7%), and South Central (+23.3%) regions.

The North Central-East (+7.4%), North Central-West (+1.9%), and West (+8.1%) regions also recorded metal-cutting orders increases from the previous month.

“Manufacturers have learned that supply chain disruptions and labor shortages are part of the landscape and are developing short and long-term strategies to address these challenges,” according to Woods. “If manufacturers can continue to successfully adapt, I can see the momentum of the manufacturing technology industry continuing into 2022.”