New Drop in Cutting-Tool Orders Shows Depth of Decline

U.S. manufacturing activity plunged from March to April 2020, as shown by the -24.7% drop in cutting-tool consumption reported in the latest Cutting Tool Market Report. The result is somewhat expected, as April represents the first calendar period during which businesses paused in the effort to contain the spread of the novel Coronavirus.

“The latest data from April simply quantifies ‘how bad’ the news is for our industry. It also appears the bad news will continue through the months ahead. The drop in oil prices along with COVID-19’s impact on automotive, aerospace, and support industries, has left its trail of destruction,” commented Steve Stokey, EVP and owner of Allied Machine and Engineering, a developer and manufacturer of cutting tools.

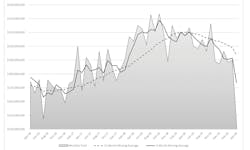

During April, U.S. machine shops and other manufacturers consumed $142.9 million, down -24.7% from March's $189.8 million and down -31.1% from the April 2019 total of $207.5 million. For the current year to-date, U.S. cutting-tool consumption stands at $717.5 million, meaning 2020 is down -14.4% compared with the January-April 2019 period.

According to Stokey: “Survival and understanding the ‘new normal’ is what is driving most decisions nowadays. One positive tidbit to note is the resiliency of our industry. Companies have implemented changes and innovated at unprecedented speeds. The phrase ‘Innovate or Die’ has never been more relevant than it is today.”