Machine Tool Orders Up, But Trend Remains Weak

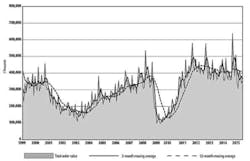

U.S. machine shops and other manufacturers increased their orders for machine tools during June, up 4.6% from May to a total of $355.43 million, according the latest release of the U.S. Manufacturing Technology Orders report. The latest result compares poorly to the June 2014 result however, down 13.2% versus the year-ago total, and brings the current year’s total new orders for “manufacturing technology” to $2.157 billion, down 8.7% from the six-month total for 2014.

The USMTO report is issued monthly by AMT – the Association for Manufacturing Technology from participating companies who produce and distribute metal-cutting and metal-forming and –fabricating equipment, and including domestically manufactured and imported equipment. The report is based on actual values for new orders, and the results are presented as nationwide totals and as totals for six regions of the U.S.

Machine tool orders are an indicator of manufacturers’ expectations, rather than current activity.

The USMTO results have declined for four of the six months of 2015, and seven of the past 12 months. Very strong results during September 2014 (concurrent with IMTS 2014) and December 2014 (an end-of-year order rush) have helped to offset otherwise lackluster demand over much of the past year.

“This monthly boost in orders is good news at face value, but belies an overall sense of concern in U.S. manufacturing,” commented AMT president Douglas K. Woods. “There was noteworthy activity in the aerospace, off road/highway construction, automotive, and contract machining industries.”

He continued: “But, if not for a dozen or so standout orders from those industries, it could have been another down month. Economic uncertainty both here and internationally continues to cause concern and hesitation to invest in capital equipment, yet opportunities remain within several core industry sectors.”

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.