EU Machine Tool Orders Fell in 2018, but Output Rose

European machine-tool producers’ new orders slowed during Q4 2018, even though the full year’s results represented a new record for machine-tool production in the region. The results were compiled and reported by CECIMO – the European Association for the Machine Tool Industries and Related Manufacturing Technologies, a consortium of machine-tool trade associations for 15 countries, who together comprise 98% of the total machine tool production in Europe and about 33% worldwide.

CECIMO reported that the eight largest European machine-tool manufacturers registered a -10% drop in orders volume during Q4 2018, compared to the same quarter previous year. Regional domestic demand was affected to a large extent (-21%), but foreign orders also weakened (-3%) during the quarter.

Within the individual markets, some of Europe’s largest machine-tool producing countries recorded sharp erosions in total orders compared to the same period of 2017: Germany (-13%), Austria (-12%), and Spain (-8%.)

Moderate pickups in new-order volume during Q4 2018 were observed only in France (+7%) and the Czech Republic (+3%).

Steep decreases in domestic orders were registered in Austria (-44%), Germany (-27%), Spain (-27%), France (-23%), and the U.K. (-20%).

In regard to foreign demand, Germany, Austria, and Spain’s indexes swung by -4%. Conversely, France saw a sharper improvement of +25%, whereas moderate increases in orders were observed in Italy (+4%) and the U.K. (+9%.)

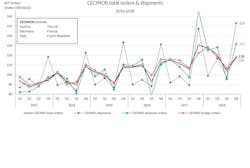

On a quarter-to-quarter basis, CECIMO observed a +13% recovery in total orders – compared to Q3 2018 – which was conditioned by seasonal factors (see the above graph of total machine-tool orders and shipments.)

The slowing of demand for European machine tools can be explained by weaker economic indicators in the E.U. and Eurozone, low business sentiment, uncertainties about global trade, and the pending outcome of Brexit.

Notably, the two largest machine-tool manufacturing countries –Germany and Italy – have experienced decreases in domestic industrial production. Moreover, these downturns had been expected because Q4 2017 registered record-high order levels and closed an exceptionally strong year (2017) for CECIMO.

Machine-tool production volumes in the region continued at a robust pace during 2018, and CECIMO reports another record-high level of output for European machine tool builders. According to estimates, during 2018 production increased by 8% over the 2017 total, reaching about €27.8 billion ($31.28 billion.

For more information on the machine-tool sector in Europe, see CECIMO’s latest Quarterly Economic and Statistical Toolbox, or contact Ms. Olga Chilat at [email protected].

About the Author

Olga Chilat

EU Public Affairs Economist

Olga Chilat is the EU Public Affairs Economist for CECIMO – European Association of the Machine Tool Industries and Related Manufacturing Technologies.