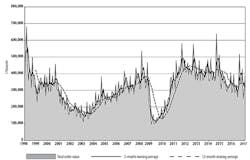

U.S. Machine Tool Orders Continued to Rise in March

U.S. manufacturers ordered $407.53 million worth of new machine tools during March, rising 34.8% over the February total and 3.3% above the year-ago result for March 2016. The positive results, which appeared to be concentrated in the Southeast and Midwest, remain 1.4% lower than the three-month total for 2016.

Data for machine tool new orders are recorded monthly by the Association for Manufacturing Technology in its U.S. Manufacturing Technology Orders report. USMTO data comprises of actual totals for machine tool sales, nationwide and in six regions, as reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

Machine tool orders are considered a leading indicator of manufacturing activity, as companies make investments to increase capacity and improve productivity.

Commenting on the March results, AMT president Douglas K. Woods called the month-to-month increase “expected, since it marked the end of the fiscal year for many companies, but it’s encouraging to see the last two months outpacing their 2016 levels – the possible start of an upward market trend.”

AMT noted various indicators — consumer sentiment, cutting tool shipments, and machine shop capital spending — show that gains for manufacturing are likely to continue.

“When manufacturers make investments to boost their capacity and productivity, it’s a good sign for a strengthening manufacturing economy,” Woods added.

In the Northeast region, new orders for machine tools remained essentially even (-0.9%) from February, totaling $66.12 million for March, though that figure is down 26.5% from March 2016. For the year-to-date, manufacturers in the Northeast have ordered $180.11 million worth of new capital equipment, a 5.9% drop versus the region’s January-March 2016 total.

In the Southeast, machine tool new orders totaled $71.35 million, up 136.9% from February; new orders for cutting tools rose 43.5% from March 2016, and the region’s three-month total for all machine tools increased 4.1% from last year’s comparable figure.

The North Central-East region reported total manufacturing technology new orders of $95.24 million, 22.9% higher than the February result but 8.5% lower than the March 2016 result. The year-to-date total is down 7.3% compared to the January-March 2016 total.

In the North Central-West, total manufacturing technology new orders rose 30.2% from February to $62.51 million, which is a 17.8% drop from March 2016 report. The region’s total manufacturing technology new orders during the month were worth $153.225 million.

The South Central region’s metal-cutting equipment new orders totaled $35.14 million for March, up 23.9% from February and up 37.5% from March 2016. Total manufacturing technology orders in the region were worth $85.95 million, AMT reported.

In the West region, new orders for metal-cutting equipment totaled $75.82 million during March, 51.3% higher than the February total and 27.7% higher than the March 2016 total. Total manufacturing technology orders in the region rose 7.5% during the first three months of this year, up 7.5% from the comparable 2016 result.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.