December Machine Tool Orders Deliver 2014 Into Positive Territory

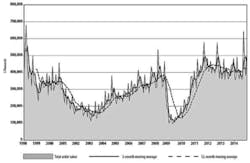

A solid increase during December drove the U.S. machine tool industry to a 3.1% increase in new orders for 2014, ending what had been a generally lackluster year on a positive note. The December orders totaled $506.89 million, an increase of 32.7% over November and 4.7% over the December 2013 order volumes.

It was the second-highest monthly total during 2014, after the peak month of September, coinciding with IMTS 2014.

For the full 12 months, the industry recorded orders totaling $5,079.05 million, up 3.1% versus the 2013 order volume. In actual numbers, U.S. manufacturers ordered 27,860 new machine tool units, hitting their highest point during September (3,486 units).

December was the second-highest volume month in terms of units ordered (2,691); January 2014 brought the lowest volume (1,821 units.)

The data is based on the monthly U.S. Manufacturing Technology Orders report issued by AMT – the Association for Manufacturing Technology, which records new orders for machine tools and related technology, based on actual data reported by participating manufacturers and distributors. It covers both domestically sourced and imported metal-cutting equipment and metal-forming and -fabricating equipment.

"The momentum we saw in manufacturing toward the end of 2014 is fueling optimism for 2015, with many major manufacturers saying they plan to hire more and invest more throughout the coming months," observed AMT president Douglas K. Woods. "The 3.1% gain in orders for the year was in line with our yearly forecast. While there are reasons for caution – a rising dollar, falling oil prices, and a shortage of skilled workers – overall we feel that the U.S. economy will continue to improve its fortunes through the first half of 2015 and manufacturing will see a measure of restrained growth."

The USMTO report also includes orders for metal-cutting and metal-forming and –fabricating equipment for six geographic regions of the United States. (Because AMT revised its geographic references in the past year, the association notes that comparisons for Metal Forming and Fabricating equipment orders are not an accurate reflection of the current data. AMT further explained that data is adjusted to reflect this change, but some categories remain unreported.)

In the Northeast, December metal-cutting equipment orders rose 95.1% from November to $82.87 million, a figure that is 26.9% higher than the $65.32 million total for December 2013. The region’s year-to-date orders totaled $798.68 million, which is 1.2% less than the comparable figure for 2013.

In the Southeast, metal-cutting equipment orders rose 13.8% from November to $56.96 million, which was 48.0% higher than the December 2013 total for the region. For the full year, the Southeast’s metal-cutting equipment orders rose 13.1% to $485.71 million.

In the North Central-East region, December manufacturing technology orders increased 72.6% to $165.27 million, and that figure was up 20.0% over the December 2013 result. The region’s 12-month total for 2014 was $1,370.52 million — or 6.6% higher than the full-year result for 2013.

The North Central-West region reported December manufacturing technology orders totaling $77.83 million, up 13.2% compared to November, but down 23.0% from the December 2013 result. For all of 2014, the region’s new orders totaled $886.59 million, 3.8% less than the 12-month figure for 2013.

In the South Central region, December manufacturing technology orders declined 22.5% from November, to $49.43 million. The 12-month total for new orders in the region is $764.37 million, up 2.2% versus the 2013 total.

Finally, the West region had metal-cutting equipment orders of $59.42 million, up 23.6% from the previous month. The region’s total metal-cutting equipment orders for 2014 rose to $749.04 million, up 6.0% over the previous 12-month period.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.