A gale of opportunity is blowing across the manufacturing field, generated by the rapidly expanding wind-turbine industry now intensifying its force in the U.S. electric utility sector, and the time is now for shops to catch it.

Many wind turbine OEMs, most of which are foreign, have already established manufacturing facilities in the U.S. These companies anxiously wait to secure domestic suppliers, and their need is predicted to grow more critical during the fourth quarter of 2009 and into the first quarter of 2010.

Wind turbine builder Nordex USA Inc., for example, a branch of Nordex AG, one of the pioneer manufacturers of multi-megawatt wind turbines, expects to produce in the U.S. at a rate of 300 turbines per year at its soon-to-open facility in Arkansas. For its U.S. production, Nordex, like other foreign turbine builders, would rather deal with local supply chains because doing so is much more cost effective.

But while there is a sense of urgency to locate domestic suppliers, U.S. shops that expect to enter the wind turbine supply chain should be aware of what turbine OEMs expect from their supplier shops, and how this industry differs from others.

Matt Garran, technical manager for the Great Lakes Wind Network – Wire-Net, an industry-based network of manufacturers and suppliers dedicated to serving the needs of the global wind market by growing the supply chain, said that shops need to do their homework before diving head first into the wind turbine market. He recommends that shops learn to know the big players, but just as important to know those companies’ expectations. Then, shops need to figure out how their individual capabilities would fit those customers’ demands.

“Examine the components of a wind turbine, and ask yourself which of those components your shop could make in the least amount of process steps and in the least amount of time. European turbine OEMs, for example, are not interested in how inexpensively a component can be made, per se, but on how costeffectively volumes of 50 to 500 part numbers can be made on an annualized basis in a production setting. And, does your shop have the experience now to achieve this? Not three years from now, but today,” said Garran.

For help, he suggests contacting his organization or the American Wind Energy Association (AWEA), and other such organizations. One key to success in the wind turbine industry is delivering on time. While the industry involves basically low-volume work, production schedules are still tight.

Garran said that if parts don’t make it to the turbine OEM on time, they can’t deliver to their customers. If OEMs can’t deliver a turbine on time, he warned, they may have to pay a late fee to the customer.

Another extremely important requirement for a potential turbinecomponents shop is having the ability to produce high-quality parts and to maintain tolerances. Quality and tolerance are critical because wind turbine components end up installed in extremely remote positions at the tops of towers, some of which are 200-ft tall. Replacing a failed part is a difficult and costly undertaking.

‘When we look at a potential supplier, we examine what their ability is to manage quality. We find out if they have the resources and systems to maintain the necessary quality levels and provide traceability,” explained Gene Cuenot, vice president of turbine builder Vestas Nacelles Americas GP&SC.

Cuenot’s company also looks at a potential supplier shop’s international industry experience. This is mainly because most of the turbine component designs have matured in Europe and thus are based on European standards, such as DIN.

“We want shops with the ability to grow with us, and we want to establish true partnerships with our suppliers, and mentor them. But, they have to make the investment to understand and meet the necessary part standards,” said Cuenot.

John Grabner, president of Cardinal Fastener & Specialty Co., a supplier of fasteners to the wind turbine industry, recommends that a shop also should be ISO-registered. This should be in addition to being able to determine and interpret European standards and specifications, and having the necessary quality systems and audited processes.

“After getting a turbine parts job, most OEMs will send an engineer to your facility to audit your quality and manufacturing processes. They will scrutinize every aspect of your shop, inside and out. They do this because they are ‘investing’ time and money in working with your shop, and they truly want you to succeed. They won’t pit you against other vendors either,” said Grabner.

As part of the quality issue, Perry Wozney, director of strategic procurement at Acciona Windpower North America, suggests shops start by determining their own core competencies/expertise, then match those to specific wind turbine components they can produce. They can drill down further by establishing what part sizes their shop can handle.

“The large part sizes in the turbine industry are relatively new to a lot of shops, as are the critical tolerances of those parts. Tolerances are typically similar to those of the aerospace industries,” added Wozney.

Parthiv Amin, president of Winergy Drive Systems (USA), a manufacturer of drive systems for wind turbines, added that, in some instances, turbine component tolerances may be even more stringent than those of aerospace. His company forms partnerships with its suppliers and establishes multi-year contracts. And a shop has to show that its partnership can be cost-effective for Winergy Drive Systems.

Acciona Windpower’s Wozney described how a typical supplier-shop approval process starts: with introductions of builder and supplier, and determining if there is a potential for doing business. Confidentiality and non-disclosure agreements are presented, and the OEM’s quality and engineering groups will visit the supplier shop and conduct audits. These, along with technical reviews, determine exactly where a shop would fit into the supply chain.

If everything checks out, the process moves to the prototyping stage, during which it is determined whether a shop will supply critical or non-critical parts.

Serial production and the traceability of quality are addressed, and shops may have to supply documents certifying where part material originated, where parts were machined in the shop, and so on, to maintain accurate records. Once the shop meets approved supplier status, there are zero defects and continuous improvement.

According to Cardinal’s Grabner, there are rules, so to speak, in the wind turbine industry. The first one his shop discovered was that wind turbine makers tend to follow the lead of their competitors.

For example, he said that in other industries most companies don’t want to hear that a shop did work for a competing company. But in the turbine industry, doing so is a benefit. It’s like a calling card that gets you in the door. In fact, turbine companies often ask potential suppliers what other turbine companies they’ve supplied. In a way, it’s a pre-qualification question.

Another rule Grabner’s shop realized was that each wind turbine company has its own way of doing things. For example, order processing will vary from one company to the next.

In addition, he advised shops to keep in mind that they will most likely be working for a foreign-owned wind turbine company in a different time zone and with their own ways of conducting business.

“Shops need to fully understand this and simply operate the way the customer wants,” said Grabner.

When it comes to a potential supplier shop’s machines, Great Lakes Wind Network’s Garran said that turbine builders look at the types of machines the shop has and its utilization per hour per day, as well as days per week. It also will determine if the shop’s machines are the “right” size for producing the components being quoted. He added that the machines don’t have to be larger ones, per se, or smaller ones, but just the right size for the component.

“You have to be manufacturing at the OEM’s level, and they want to know what the working envelopes of your machines are, their weight capacities, what tolerances can be held, and if your shop has coordinate measuring machine capability,” Garran said.

Look for more articles on the wind turbine industry in coming issues of American Machinist.

Coming to America

Siemens Energy is one foreign company that plans to serve the strong demand for wind turbines in the Americas better, with a U.S. nacelle production facility. It will be the company’s first and will be built in Hutchinson, Kan.

Construction of the new plant is slated to begin in August 2009, and the first 90-ton nacelle should be shipped from the factory in December 2010. The Kansas operation will be the first major wind turbine equipment factory in that state, and promises to create an estimated 400 “green collar” jobs.

The Hutchinson facility will produce the company’s 2.3-MW wind turbine product family. Initially, the factory’s planned yearly output is approximately 650 nacelles – or 1,500 MW.

“The United States already is and will continue to be one of the world’s fastest-growing wind energy markets. We are thus intensifying our global position in this field,” said Peter Loscher, CEO of Siemens AG.

As proof of the growing demand, Siemens Energy recently received its first U.S. order for 33 units of its new SWT-2.3-101 wind turbines for the Bison I wind project to be located near Center, N.D.

As a two-phase project, the first 16 turbines are planned for installation in 2010, and the remaining 17 units in 2011. When completed, the wind farm should have a generating capacity of as much as 75 MW. The purchaser is Minnesota Power, an electric utility striving to diversify its energy mix and grow its renewables portfolio. Once operating, the wind farm will provide clean power for more than 22,500 homes in Minnesota.

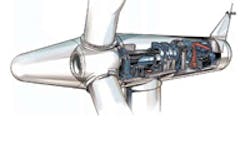

| The Basic Wind Turbine There are typically three blades connected to a hub. Blades can measure up to 200-ft long and weigh as much as 40,000 lb. Hubs connect to shafts that run inside nacelles to gearboxes and generators. Blades, hubs and nacelles are mounted to tower tops. Nacelles house all the internal turbine workings, including hydraulics power supplies, generator frame, and control cabinets for electronics. Generator frames, as well as gearbox frames, are typically fabricated components. Nacelles can measure as much as 15-ft long and 10-ft wide. Gamesa Corp., a wind turbine maker based in Spain and with a production center in Pennsylvania, assembles its nacelles by first connecting the front frame, with all its components, to the rear frame and its components. The company then places the nacelle assembly into a lower housing and assembles power transformers and the main shaft/gearbox subsets. The process continues with the company aligning the generator assembly and connecting all the electrical components in the control cabinet. Once this connection is made, Gamesa conducts a comprehensive, final verification check by simulating actual wind-farm operation. After passing the test, the nacelle’s upper housing is assembled, and the nacelle goes to its corresponding wind farm. For its turbine towers, Gamesa uses plated steel sheets formed into cylinders. The company submerge arc-welds these ring sections to form different lengths. Depending on the required tower height (between 14 and 29 meters), between 4 and 12 rings can make up each section. |