German Machine Tool Orders Up Again

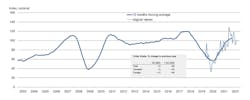

German machine-tool builders reported a 9.0% year-over-year increase in new orders for the third quarter of 2022, continuing a sustained recovery from the weak results of 2021. During the most recent quarter, orders from German manufacturers were up 3.0%, while foreign customers orders were up 12.0% for the period.

The German manufacturers’ new-order data is supplied on a quarterly basis by the German Machine Tool Builders’ Assn. (VDW), which represents one of the largest components of the mechanical engineering sector in that country, and one of the largest machine-tool manufacturing industries in the world.

Through nine months of the current year, new orders have increased 26.0%, with demand coming almost equally from foreign and domestic (German) buyers. For comparison, U.S. machine shops’ new orders for the January-September period were 2.7% higher than the nine-month total for 2021, according to AMT’s U.S. Manufacturing Technology Orders report."Our industry's orders have held up well so far, despite all the adverse factors. Although the growth is clearly slowing, both September and the third quarter as a whole are positive," stated VDW executive director Dr. Wilfried Schäfer.

"However, there was an 8.0% percent increase in producer prices in the machine tool industry in the third quarter,” Schäfer continued. “The effect of this was that earnings stagnated on a price-adjusted basis. As we are seeing everywhere, inflation is eating away at our growth."

For historical reference, VDW detailed that 2022 YTD orders are just 7.0% lower than the record volume posted for 2018; the record level has been matched by foreign orders, though the domestic order volume is 20.0% below the record figure for that period.

VDW further noted that German machine-tool builders’ capacity utilization rates rose above 90.0% during October, indicating improvements in supply-chain complications that have affected the sector during the past two years.

"The supply bottlenecks are now easing slightly, it seems," Schäfer said.

The VDW members’ sales volumes rose 10.0%, January-September, with cutting-machine builders’ sales increase 17.0%, and forming-machine builders’ sales down 6.0%.

VDW forecasts new machine-tool orders to decline during Q4 2022, as German and European manufacturing activity is trailing activity in other regions of the world. A worsening energy shortage in Europe is another looming factor.

"Nevertheless, we will finish the year with overall growth in production," according to Schäfer. The order backlog generated through the first three quarters of the year will sustain production levels through the remaining weeks of 2022, he explained.