New Orders for Machine Tools Slip from Recent Peak

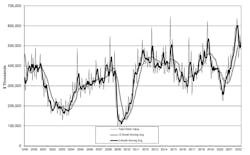

New orders for machine tools fell to $513.44 million in April, down -6.8% from March and yet 27.5% higher than the April 2021 order total. It was the second consecutive monthly result topping $500 million, and drove the year-to-date total for manufacturing technology orders to $1.98 billion, 26.6% higher than the January-April 2021 figure.

The figures are supplied by AMT – the Assn. for Manufacturing Technology in it’s monthly U.S. Manufacturing Technology Orders report, which compiles nationwide and regional data of new orders for metal-cutting and metal-forming and -fabricating machinery.

USMTO totals – presented in actual dollar values – serve as a forward-looking indicator of overall manufacturing activity, as machine shops and other manufacturers make capital investments in preparation for demand expected in the weeks and months ahead.“Despite these strong results, there’s clearly been a lot of news related to declining consumer sentiment, everything from inflation to high interest rates to the war in Ukraine,” commented AMT president Douglas K. Woods. “While consumer sentiment has been low since April 2021, consumer demand continues to hit record highs, leveraging consumers’ amassed savings as well as large capital-investment pools looking for high-value market opportunities.”

Manufacturing technology demand rebounded well from 2020 to 2021, but a range of uncertainties (inflation, supply chain gaps, a shortage of skilled workers) shaping industrial and consumer demand has been gradually slowing machine shops’ capital investments from the recent peak of $637.3 million recorded last November.

“April USMTO numbers reflect ongoing consumer spending, particularly fueled by demand for manufactured goods, such as aerospace and other capital-heavy industries,” Woods continued. “Based on available economic projections, we had anticipated orders to gradually soften through the middle of the year. However, that pullback has not happened, and signs point to above-average orders for manufacturing technology into the beginning of the summer.”

The April regional results showed improved month-to-month order values only in the North Central-East region, up 9.0% from March, and the North Central-West region, up just 2.5% from the previous month.

The Southeast region’s March result fell dramatically from March to April, -36.6%. Nevertheless, every region showed double-digit increases in year-over-year and year-to-date new-order values.