Machine Tool Orders Hit a New Peak for 2021

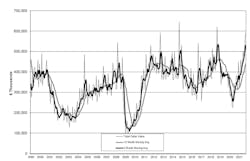

U.S. machine shops and other manufacturers ordered $589.96 million worth of new machine tools during September, 8.9% more than during August and 58.1% more than during September 2020, continuing the robust rise in capital spending on manufacturing technology. It is the second consecutive month of rising demand for new machinery, and the highest monthly total for 2021. Through nine months of the current year, machine-tool new orders total $4.115 billion, 53.1% higher than last year’s order volume, according to the U.S. Manufacturing Technology Orders Report.

The AMT-Assn. for Manufacturing Technology’s monthly USMTO report summarizes machine shops’ capital investments in new machine tools. The nationwide and regional data summarizing new orders of metal-cutting and metal-forming and -fabricating machinery – presented in actual dollar values – serves as a forward-looking indicator of overall manufacturing activity.

“It took 31 months after the bottom of the 2008-2009 financial crisis to have a single month with half a billion dollars in orders, but September is the third month of 2021 exceeding that mark,” observed AMT president Douglas K. Woods.“Economists project the United States is past peak growth, yet machine orders remain at a record pace to meet remaining consumer and producer demands,” Woods added.

He pointed out, however, that the September report shows particular strength in certain market segments, and notably it was not among machine-shop buyers, whose orders slipped -7.0% from August. “Machine shop orders usually dictate the direction of the month,” according to Woods. “September 2021 was an exception to that trend, which highlights the breadth of the recovery across manufacturing sectors.”

The engine, turbine, and power-generation sectors had the largest share of orders in September 2021 and their highest monthly value since December 2011.

AMT commented that those investments point to efforts to increase power-grid resilience.

The September report also shows some regional variance in new orders for metal-cutting equipment: the South Central region posted a monthly total of $58.85 million, a 37.0% month-to-month increase and a 159.4% year-to-year increase in new orders for metal-cutting equipment. The region’s year-to-date order total is $319.38 million, +68.3% ahead of 2020.

Increases also were reported for metal-cutting machinery orders in the North Central-East ($135.58 million, +24.7% over August, +73.8% over September 2021, +52.3% YTD) and Northeast ($101.00 million, +17.4% / 64.3% / 52.4%) regions.

The North Central-West region posted September metal-cutting machinery orders for $119.78 million, only a slight monthly rise (1.6%), while still reporting very strong year-over-year (+57.7%) and YTD ($834.93 million, +92.2%) increases.

The remaining two regions posted decreases in new orders during September but remain well ahead of the 2020 totals. In the Southeast, September total ($63.86 million) is -0.3% lower than August, but +31.9% higher than September 2020 and the YTD total of $453.32 million is +17.3% YTD.

In the West, September’s $104.03 million is -8.9% less than August and +45.1% ahead of September 2020, and the nine-month total of $754.13 million is 41.8% higher than last year.