US Machine Tool Orders Fell Again in August

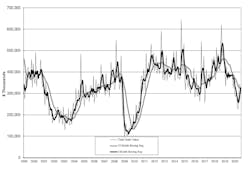

U.S. machine shops and other manufactures booked new orders worth $297.7 million during August, -11.5% less than during July and -21.7% less than during August 2019. These orders bring the 2020 year-to-date (January to August) to $2.3 billion, which is -24.3% less than the eight-month total for 2019.

The data is provided by AMT – the Assn. of Manufacturing Technology in its latest U.S. Manufacturing Technology Orders report. The monthly report is a forward-looking index to manufacturing activity, tracking manufacturers capital investments in anticipation of future work orders.

The USMTO presents new actual figures for orders of metal-cutting and metal-forming and -fabricating equipment, nationwide and in six geographic sectors. It is based on information supplied by participating producers and distributors of that equipment.

“Despite a decrease in total orders, more than half of the industries we track experienced month-over-month increases (during August), including appliances, electrical components, and automotive components,” stated AMT president Douglas K. Woods.

“Additionally, it is noteworthy that the average value of units increased from about $143,000 in the spring to $175,000 in late summer," Woods said. "Although this can be caused by different factors—an increase in orders of high-end equipment and/or an increase in margins overall—both are positive news for the industry.”

The August data for regional orders of metal-cutting equipment showed particular strength in the North Central-West (up 55.5% from July, to $56.68 million) and South Central (up 44.7% from July to $27.36 million), but results from other regions were negative.

The month-to-month declines in August order volumes were less severe in the West (-6.8%) and Southeast (-7.7%) regions, but more notable in the Northeast (-13.8%) and significant in the North Central-East (-48.3%) regions.

However, the regional results are indicative of trends within industrial sectors that have particular seasonal dynamics. AMT's Woods emphasized the longer and broader trends apparent in the latest report. “Analyst predictions in May were that the industry would be down 50% for the year, and currently the industry is tracking closer to 24% down for the year," he said.

"Indicators continue to improve with PMI (the Institute for Supply Management's Purchasing Managers Index) holding strong at over 50 and capacity utilization experiencing its fourth-straight month of improvement," Woods continued. "Given the stabilization of prices and the increased demand in so many sectors, we continue to be optimistic that the recovery is moving in the right direction.”