US Machine Tool Orders Down 39% for April

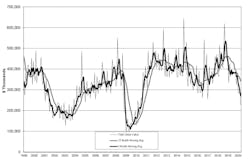

U.S. machine shops' and other manufacturers' capital-equipment orders fell -26.3% from March to April 2020, totaling $225.8 million. It is the lowest single-month total for the U.S. Manufacturing Technology Orders report since May 2010, according to AMT – the Association for Manufacturing Technology. The USMTO report tracks orders for metal-cutting and metal-forming and -fabricating equipment ("manufacturing technology"), nationwide and in six geographic sectors. It is based on information supplied by participating producers and distributors of that equipment, and represents a leading indicator of manufacturing activity as investors prepare their operations for customers' future work orders.

While monthly new-order totals began to decline in the second half of last year, the current USMTO total is -37.8% lower than the April 2019 result, and it brings the current year's total to $1.097 billion, -28.2% than the January-April 2019 new orders.

“It should not come as a surprise that April numbers were low given the large-scale shutdown of the global economy,” said Douglas K. Woods, president of AMT. “Data confirms that U.S. industrial production dropped lower than during even the Great Depression."

The USMTO regional data generally followed the double-digit declines shown in the nationwide data, with two exceptions: New MT orders in the Northeast region rose 30.9% from March to April; and in the South Central region they rose 13.0% during that period.

Woods predicted that May orders will show some encouraging signs: "The aerospace and automotive sectors have begun retooling and are placing orders for new equipment to ramp-up production in the fall," he said. "Some manufacturing technology orders are being delayed, but we are not seeing any cancellations."

Still, Woods acknowledged that the current year's prospects are determined already. “2020 will still be a down year for manufacturing technology orders, and we think it is likely that manufacturing will experience uneven growth for the next several quarters," he said. "Consumer confidence, capacity utilization, and the unemployment rate are the key indicators that we will keep our eyes on as they chart future performance.”