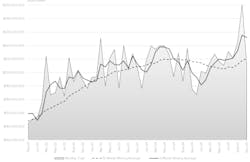

CNC machine shops and other U.S. manufacturers purchased $206.1 million worth of cutting tools during November 2025, a -17.6% decrease in order value from October but 9.9% more than the comparable year-ago figure for November 2024. Cutting tool orders are seen as an effective index to overall manufacturing activity, as those products are critical consumables for manufacturers supplying major industries like automotive, aerospace, construction, defense, energy, and numerous others.

Machine shops and other manufacturing operations order cutting tools according to their current and anticipated manufacturing requirements.

The data is drawn from the latest Cutting Tool Market Report, a monthly summary of cutting-tool shipments maintained by USCTI and AMT - the Assn. for Manufacturing Technology.

Steve Stokey, executive vice president and owner of Allied Machine and Engineering, a cutting tool manufacturer, stated: “The market typically shows a significant drop-off in November, and this year was no exception. That seasonal dip also impacted the three-month moving average in typical fashion.”

For the 11-month period of January through November 2025, cutting-tool shipments totaled $2.34 billion, up 1.3% from January-November 2024.

“The good news is the 12-month moving average continues its gradual upward trend,” according to Stokey.

A similar October-to-November drop in new-order value was shown in AMT’s latest U.S. Manufacturing Technology Orders report, but that is an index to future manufacturing activity – showing investments made by machine shops and other in expectation of new business. That report has consistently presented evidence that the year-over-year increases in order values demonstrate higher unit prices and not higher volume of shipments.

The cutting tool order activity shows a similar development.

“Cutting tool manufacturers and importers are doing their best to control prices, but it has become more apparent that the overall prices for carbide and HSS-based products are on the rise,” commented Jack Burley, chairman of AMT’s Cutting Tool Product Group and president of cutting-tool manufacturer Big Daishowa. “The latest trend shows that more products are sold in terms of total dollars, but the number of units delivered remains normal. Agriculture and automotive production remain flat, whereas aerospace and defense continue to produce at very high levels.

“As we approach 2026, I am optimistic that costs and production will settle in for unit growth after a turbulent year of uncertainty,” Burley concluded.

“2025 was anything but normal – but what’s new in business? We persevere, we figure it out, and we keep serving our customers,” Stokey added. “The trends suggest the table is set for a stronger 2026. It should be exciting to start selling in a rising-tide environment again.”

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.