Cutting Tool Orders Face Tariff Uncertainty

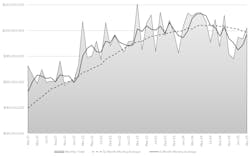

U.S. manufacturers ordered $207.1 million worth of cutting tools during March, 4.3% more than during February but -4.2% less than the total for March 2024. The total value of cutting tool shipments for the year to date (January-March 2025) stands at $605.6 million, which is -5.9% less than the Q1 total for 2024.

The U.S. Cutting Tool Institute and AMT - the Assn. for Manufacturing Technology compile the shipment date for their monthly Cutting Tool Market Report, which incorporates data from manufacturers and distributors of cutting tools. Because cutting tools represent large consumable purchases in support of automotive, aerospace, energy, and numerous other industrial sectors, shipments of cutting tools are an indicator of overall manufacturing activity.

AMT’s Cutting Tool Product Group Jack Burley described the March data as a reflection of the moment when the U.S. announced a variety of tariffs on imported materials and products. “Despite the uncertainty from Washington, it was still business as usual for most companies,” he said.

“However, most tooling manufacturers are either dealing with increased tariffs for products sourced abroad or increased costs for raw materials like tungsten carbide, or both,” Burley continued. “These increased costs for perishable tools are already getting passed on, resulting in a hit to the operating mar-gins for manufacturers.”

One cutting tool supplier maintained an optimistic view. “March cutting tool sales improved over February and were at the highest level we have seen since October 2024,” offered Bret Tayne, president of Everede Tool Co. “Despite the improvement, year-over-year sales remained below 2024 levels for the third consecutive month. Although this data precedes the ‘Liberation Day’ tariff announcements, I’ve anecdotally heard optimism that the current volatility will be short-lived, and modest growth will return in the second half of the year.”