US Cutting Tool Demand Still Lagging

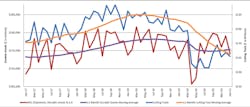

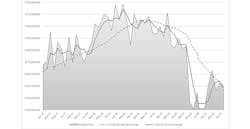

U.S. machine shops and other manufacturers purchased $152.2 million worth of cutting tools during January 2021, a -3.2% decrease in demand from December 2020, and a -21.8% decrease from the January 2020 level – indicating that manufacturing activity has yet to resume the healthy rate of activity that would signal the start of recovery from a cyclical decline that started in mid-2019 and then compounded by the COVID-19 pandemic.

The figures are drawn from the latest Cutting Tool Market Report released jointly each month by AMT – the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute. The CTMR tracks cutting-tool consumption, as an indicator of overall manufacturing activity because cutting tools are used to produce components used by virtually every industrial sector. CTMR data includes report from participating companies that represent the majority of the U.S. market for cutting tools, and the wide application of cutting tools across multiple industries is comparable to durable-goods orders, according to the report's authors.“January shipments levels are better than the dismal numbers in May 2020 but don’t reflect a recovery in Q1 business levels either,” according to Brad Lawton, chairman of AMT’s Cutting Tool Product Group. “However, I expect a recovery to begin in our industry soon as the government stimulus translates into greater manufacturing levels early in 2021.”

The latest AMT U.S. Manufacturing Technology Orders Report -- which offers an index to future manufacturing trends based on new orders for manufacturing capital equipment – also revealed slower activity in January. But that report also showed a double-digit rise over the January 2020 new-order total, signaling a steady recovery in manufacturing demand.Greg Daco, chief U.S. economist at Oxford Economics USA cited by AMT/USCTI, said that a weaker U.S. dollar and recovering global growth during 2021, along with significant U.S. government spending on infrastructure, climate change initiatives and R&D, may be expected to fuel growth in manufacturing activity over the coming months.

Lawton said full recovery in cutting-tool consumption remains somewhat distant. “In January, cutting tool shipments were -22% lower than last year despite durable goods shipments being +6.2% year-over-year higher than in January 2020. Improving health conditions, expanding vaccine distribution, and generous fiscal stimulus will form a powerful cocktail that lifts economic activity this year.”