Cutting Tool Orders Signal a Rebound

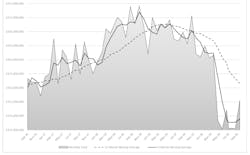

Machine shops and other U.S. manufacturers purchased $156.1 million worth of cutting tools during September, +14.7% more than during August but -20.5% below the September 2019 total. As cutting-tool consumption is an index to the current rate of overall manufacturing activity, the September results reinforce the impression that domestic manufacturers are beginning the process of recovery from a recession that has been in process for about 12 months, but made more complicated by the halt in industrial activity due to the COVID-19 pandemic.

Through September, cutting-tool consumption totals $1.4 billion, meaning that the 2020 purchases trail the January-September 2019 volume by -23.1%.

All the figures are supplied by AMT-the Assn. for Manufacturing Technology and the U.S. Cutting Tool Institute in their jointly compiled Cutting Tool Market Report (CTMR.)

The September U.S. Manufacturing Technology report, AMT’s monthly index to future manufacturing demand, showed strong indications of recovery in mold/die and housing-related manufacturing, but ongoing weakness in aerospace and oil-and-gas.

“Many of us in the cutting-tool industry also watch the machine tool orders and those numbers improved in the recent month as well,” Kaiser continued. “At this point we are optimistic about the fourth quarter. We are not counting on a large Christmas present but just looking for some steadiness in the market and no further shutdowns.”

According to Brad Lawton, chairman of AMT’s Cutting Tool Product Group, “we have seen an improvement of sales numbers, which is a whisper to reduce the uncertainty from the 2020 year of trauma. The cutting tool industry will recover, but we all know it will take time and we must be patient. Stay focused and we will see the numbers continue to improve.”