CAM Software Market Analysis Finds Leaders, and Risers, for 2010

CIMdata Inc., an independent management consulting and research firm focused on the global product lifecycle management (PLM) sector has named the top CAM software products for 2010 in the new release of its NC Market Analysis Report, Version 20. Dassault Systèmes was the 2010 market leader, based on direct supplier revenues and end-user payments for CAM software and services; and Planit Holdings is the annual leader in terms of industrial seats shipped.

Planit Holdings also led the sector on the basis of industrial seats installed. Siemens PLM Software’s NX was the market leader in industrial seats shipped by brand, and CNC Software’s Mastercam was the leader in both industrial and educational seats installed by brand name. C&G Systems Inc. — the new company that resulted from the merger of Graphic Products Japan and Computer Engineering Inc. — earned recognition as the fastest growing (“the most rapidly growing”) supplier, with a 91.4% score.

“Even though there have been a number of recent mergers and acquisitions, the CAM software market continues to be highly fragmented and competitive,” noted CIMdata chairman Alan Christman, the author of the study. “There is no single supplier or small group of suppliers that dominate the worldwide market, and this is illustrated by the number of different market leaders depending on the ranking category.”

Version 20 of the NC Market Analysis Report is available for purchase. Contact CIMdata at Tel. 734-668-9922, or by email to [email protected].

CIMdata tracks approximately 50 CAM software suppliers and the rankings in its report list 15 to 30 suppliers, depending upon the category. “2010 was a rebound year for the CAM software market as the estimated overall market size for end-user payments grew by 7.6%, from $1.239 billion to $1.333 billion,” CIMData research director Stan Przybylinski observed. “CIMdata projects that the overall market will continue to grow in 2011 by 6% to $1.412 billion.”

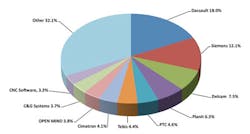

The leading suppliers for 2010 based on direct revenue from CAM software and services were Dassault Systèmes, Siemens PLM Software, Delcam, Planit Holdings, PTC, Tebis, Cimatron, OPEN MIND Technologies, C&G Systems, and Missler Software.

Dassault Systèmes and Siemens PLM Software were the market leaders with double-digit market shares and a combined market share of 30.6%.

The remaining eight suppliers in CIMdata’s top ten had a combined market share of 37.4%, and the suppliers below the top ten had a combined market share of 32%.

Globally, 2010’s top five CAM suppliers in terms of end-user payments lined up the same as in the revenue rankings — i.e., Dassault Systèmes, Siemens PLM Software, Delcam, Planit Holdings, and PTC.

Delcam called attention to its achievement as the sector’s largest specialty supplier, and as the recipient of the highest vendor revenues and the highest end-user payments of all CAM-centric companies. “This means that the company has completed 11 years as the world’s leading CAM specialist, having first achieved its global leadership in 2000,” Delcam pointed out in a statement.

“By employing the industry’s largest development team, we are able to produce the world’s most comprehensive collection of machining software from any supplier,” explained Delcam CEO Clive Martell.

However, the end-user payments ranking revealed differences in the second half of the top ten. Tebis, Cimatron, OPEN MIND Technologies, C&G Systems, and Missler Software held positions six through 10. The changes typically reflect a greater use of resellers as compared to direct sales, according to CIMdata.

The estimated top five suppliers in 2010 based on CAM industrial seats shipped were Planit Holdings, Delcam, Siemens PLM Software, Dassault Systèmes, and CNC Software. The seat-count rankings are significantly different than the supplier-revenue rankings, reflecting differences in cost-per-seat. The 2010 rankings of brands on the basis of industrial seats shipped were Siemens’ PLM Software NX, Dassault Systèmes’ CATIA, CNC Software’s Mastercam, PTC’s Creo Parametric (the former Pro/ENGINEER), and Planit Holdings’ EDGECAM. The changes in rankings are primarily due to the differences in level and breadth of product and associated software pricing among the suppliers, CIMdata explained.

The five fastest growing CAM software suppliers on the basis of revenue in 2010, compared to 2009, were C&G Systems, SolidCAM, Geometric Technologies, CG Tech, and CNC Software. CIMdata projects that the five fastest-growing companies in 2011 will be SolidCAM, Geometric Technologies, Delcam, CGTech, and Cimatron, and it noted that SolidCAM, Geometric Technologies, and CGTech are expected to be among the top five fastest-growing companies in both years.

Other supplier rankings contained in Version 20 of the NC Market Analysis Report include the educational market; revenue by geography and industry; revenues for verification and post-processing suppliers; the total numbers of people in the company, product development, and direct sales; and the number of resellers per company.