China Dominates Industrial Robot Installation

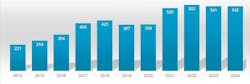

The International Federation of Robotics issued its annual summary of industrial robot statistics, highlighting that 542,000 robots were installed during 2024 – the second-highest annual total for installations in history, and a number that IFR noted is more than double the number of installations 10 years ago. It was the fourth-consecutive year that annual robot installations topped 500,000 units, with a remarkable 74% of those installations happening in Asia.

The group’s annual World Robotics report offers statistics, trends, and analysis of the global robotics market, including cobots, service robots, and mobile robots.

IFR president Takayuki Ito pointed out that the sustained demand for industrial robotics parallels other investment trends for manufacturers. “The transition of many industries into the digital and automated age has been marked by a huge surge in demand (for robotics),” according to Ito. “The total number of industrial robots in operational use worldwide was 4,664,000 units in 2024 – an increase of 9% compared to the previous year.”

The continued dominance of Asia in recording robot installations is unsurprising in view of the number of installations recorded in China: that country deployed 295,000 industrial robots, or 54% of all robot installations during 2024. China is by far the world’s largest market in 2024, representing 54% of global deployments. The latest figures show that 295,000 industrial robots have been installed - the highest annual total on record.

More consequential may be the detail that, for the first time, Chinese manufacturers accounted for more deployments there than foreign suppliers. The native suppliers now hold 57% of the domestic market share, a portion that has nearly doubled during the past decade.

China also has more robots in operation than any other country, more than 2 million.

Elsewhere in the region, Japan is still the world’s second-largest market for industrial robots, with 44,500 deployments recorded last year, and 450,500 units in use overall.

South Korean businesses installed 30,600 robots during the last year, -3.0% year-over-year, but ranks fourth in the world for total robots in use.

The Indian market for industrial robots is growing, up 7.0% year-over-year, with 9,100 units installed for 2024.

The United States recorded 34,200 robot installations during 2024, a -9.0% decrease from the previous year. “The United States is highly automated running the third-largest stock of industrial robots worldwide, behind only Japan and China,” IFR’s Ito observed. ‘However, a comparison of the US and China reveals the enormous automation potential of the world's largest economy by GDP.” / IFR

The U.S. automotive sector remains the largest domestic market for robots, with 40% of total U.S. installations in 2024: Sales of robots for automotive operations totaled 13,600 units, up 11% year/year.

The U.S. “metal and machinery” operations – a diverse range of activities, from melting and pouring, to handling, machining, and welding – accounted for 3,500 robot units – down -15% from 2023.

U.S. “electrical and electronics” production accounted for 2,800 robot deployments in 2024, down -23% from the previous year.

Robot installations in the U.S. food and beverage industry increased 21.0% last year to 2,200 units.

“The United States is highly automated running the third-largest stock of industrial robots worldwide, behind only Japan and China,' according to Ito.

According to IFR, the short-term outlook for U.S. robot deployments is uncertain due to the effects of tariffs on foreign imports, but the long-term view is positive as reshoring and labor shortages will bring opportunities for new deployments.

In Europe, industrial robot installations dropped -8.0% in 2024. Despite the decrease, the 85,000 installed represent the second largest annual total for robot deployments in the region, and 80% (67,800 units) were installed in European Union countries.

Globally, the IFR forecasts robot installations will grow by 6% to 575,000 units in 2025, and that total installations will pass 700,000 units by 2028.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.