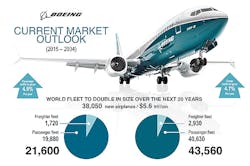

Boeing Commercial Airplanes issued a new 20-year forecast for global aircraft demand, projecting a need for 38,050 new jets through 2034, 3.5% more than it detected in a comparable report issued in 2014. It projected the total value for those aircraft would be $5.6 trillion over the term, which is 7.7% more than the $5.2 trillion it pegged to last year’s demand forecast. By 2034, Boeing noted, the world’s commercial airplane fleet will have doubled from of 21,600 (the 2014 total) to 43,560 aircraft. Of the 38,050 jets to be delivered during that span, 58% will have accommodated growth in the commercial aircraft market rather than replacing obsolete jets."The commercial airplane market continues to be strong and resilient," summarized Randy Tinseth, v.p. of marketing for the OEM’s commercial aircraft business. "As we look forward, we expect the market to continue to grow and the demand for new aircraft to be robust."

In particular, air passenger traffic will continue growing at about 4.9% annually (near on track with the historic trend of 5%), as over 7 billion passengers will fly over the course of the 20-year forecast period.

Cargo traffic will grow at about 4.7% per year, Boeing added.

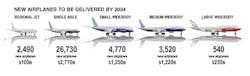

Among the types of commercial aircraft in demand, Boeing predicts the single-aisle market will remain the fastest-growing and largest segment of the overall market, and will require 26,730 new jets over the 20-year term. “These aircraft are the foundation of the world's airline fleet, carrying up to 75% of passengers on more than 70% of the world's commercial aviation routes,” Boeing noted, and it’s also the portion of the aircraft market benefiting most from demand by low-cost carriers (about 35% of demand) and airlines in developing and emerging markets – two of the factors contributing most significantly to new demand.

Asia, in particular China, will continue to lead all global regions for total airplane deliveries over the coming decades, with 14,330 deliveries anticipated through 2034.

North America will be second, but with 7,890 new deliveries, the forecast demand is about 45% less than Asia’s requirements. The European market is forecast to demand 7.310 new aircraft.

The single-aisle market is also the venue for a steady competition by Boeing and it’s primary rival Airbus, with each one relying on their single-aisle jets for a large percentage of revenue. Both also are set to introduce new single-aisle aircraft models in the near future: Boeing’s 737-800 and 737 MAX models will offer more fuel-efficiency and passenger amenities, to address the expanding demand in that sector. Similarly, Airbus is preparing a redesigned version of its A320 series.

"Low-cost carriers will require airplanes that combine the best economics with the most revenue potential. With 20% lower fuel use, the 737 MAX 200 will be the ideal machine for them," Tinseth noted.

As for the higher-profile, wide-body aircraft sector, Boeing forecasts global demand will total 8,830 new aircraft during the 20-year forecast period. Of this total, smaller wide-body jets (200-300 passengers, e.g., Boeing’s 787-8 and 787-9 Dreamliners) will be in the greatest demand. “This year's forecast reflects a continued shift in demand from very large airplanes to efficient new twin-engine products such as the 787 and new 777X,” the jet builder observed.

About 2-3% of the current commercial aircraft fleet will require replacement over the 20-year period, according to Boeing.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.