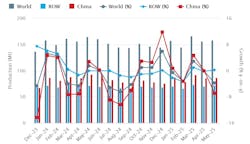

Global raw-steel production improved to 158.8 million metric tons during May, a 2.0% rise from the April total, with a generally positive trend apparent in most of the largest steelmaking countries – even as the annual and year-to-date comparison shows steel output continuing to slow due to weak demand.

The tonnage is reported each month by the World Steel Assn., which tracks raw-steel production in 70 countries. World Steel’s May report shows that global production is down -3.8% from May 2024, and the 784 million metric tons produced for the year-to-date represents a -1.3% from January-May 2024.

The current report covers the period of implementation for new U.S. tariffs on steel imports, a development that caused World Steel to forego its semiannual outlook report for global steel consumption.

In the outlook published in Q4 2024, World Steel forecast ongoing weak demand from industrial and construction markets, which has been evident by the multi-year trend of steelmakers in most industrialized regions curtailing surplus tonnage that may weaken prices.

This broad situation also reflects the reality of the Chinese steel industry, which consistently and significantly produces at rates beyond domestic and regional demand. During 2024, China produced more than 1 billion metric tons of raw steel, about 55% of the total world output. In May, China produce 86.6 million metric tons, 54.5% of the global total, and yet that amount was a -6.9% reduction of China’s May 2024 output.

For the year-to-date, Chinese steelmakers have produced 431.6 million tons of raw steel, or -1.7% less than in the January-May 2024 period. All this suggests an ongoing but insufficient effort by Chinese steelmakers to resolve the overcapacity issue – a reading that is supported by the steel output results in other major markets.

India, however, represents a separate case: the expanding Indian industry produced 13.5 million metric tons of raw steel during May, 4.4% more than during April and 9.7% more than in May 2024. For the current year to-date, Indian steelmakers have produced 67.2 million metric tons, 8.2% more than during January-May 2024.

Japanese steelmakers produced 6.8 million metric tons during May, up 2.8% from their April output but still -4.7% less than their May 2024 total. Through five months of 2025, steelmakers in Japan report 33.8 million metric tons of steel output, -5.2% less than during the comparable period of last year.

The world’s fourth-largest steelmaking nation – the United States – produced 7.0 million metric tons (7.7 million short tons) during May, up 5.7% from April in what may yet prove to be an effect of the 25% tariffs on steel imports put in place on March 1, and later increased to 50% on June 4. The May result is 1.7% higher than the May 2024 total, and the year-to-date steel output for U.S. steelmakers stands at 33.4 million metric tons (36.8 million short tons), roughly the same (+0.3%) as January-May 2024.

Russian steelmakers produced an estimated 5.8 million metric tons during May, the same as in April, but that is a -6.9% drop from May 2024 and it brings the YTD output to 29.2 million metric tons, or -5.2% lower than January-May 2024.

South Korean steelmakers produced 5.1 million metric tons of raw steel during May, 2.0% more than during April and -1.7% less than in May 2024. The five-month total tonnage for South Korea in 2025 is 25.6 million metric tons, or -3.0% less than the comparable result for last year.

In the European Union – 27 nations – May raw steel output was 11.4 million metric tons, or -3.1% less than May 2024, and the region’s year-to-date output its 54.9 million metric tons, or -2.5% below last year’s total for the same five-month period.

Included within the EU total for May are the German steelmakers’ 3.0 million metric tons, unchanged from the April report and -6.4% lower than the report for May 2024. The German industry’s output for January-May is 14.4 million metric tons, down -10.8% from last year’s comparable result.