Nano Dimensions Bids for Stratasys, Again

Nano Dimension launched a renewed bid to take over rival additive-manufacturing system developer Stratasys, with a proposal that values the latter business at about $1.1 billion. The would-be buyer said its offer is 40% higher than the Stratasys share price at the end of September – when that company’s shareholders rejected an effort to merge with rival Desktop Metal.

With a 12.22% stake, Nano Dimension is already the largest shareholder in Stratasys, but it noted it has a current liquidity of more than $800 million and is prepared for the $16.50/share offer to rise. In March when it proposed to takeover Stratasys, Nano Dimension offered $18.00/share.

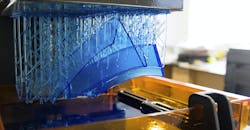

Acquiring Stratasys would expand Nano Dimension’s additive manufacturing portfolio in terms of the materials and software it offers, its in-house expertise, and its distribution network. While it currently offers systems for printing polymer, metals, and ceramic materials, incorporating Stratasys 3D-printing systems reportedly would give Nano Dimensions a wider range of options for printing polymer materials.

Stratasys acknowledged receiving the takeover bid, and responded that it will conduct “a comprehensive strategic review” before responding.

Waltham, Mass.-based Nano Dimension has stated it is willing to begin the required information-sharing necessary to certify its bid, but noted that its current “deep understanding of Stratasys and the AM industry” will mean that only a short evaluation period will be needed.