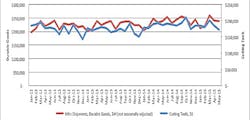

U.S. manufacturers consumed $172.8 million worth of cutting tools during May, down 5.8% from the April total, and down 7.0% from the May 2014 total. The figures are reported by the U.S. Cutting Tool Institute and AMT-the Association for Manufacturing Technology, who together issue the monthly Cutting Tool Market Report as an indicator of manufacturing activity.

The latest result represents the second consecutive monthly decline in cutting tool consumption, and the fourth month of the five Cutting Tool Market Reports issued this year. Declining demand is also evident in demand for new machine tools and related technology, as evidenced in the monthly U.S. Manufacturing Technology Orders report issued by AMT, though that study tracks investment in new cutting capacity, not manufacturing activity.

According to the AMT and USCTI (who represent developers, manufacturers, and distributors of cutting tools and the machinery in which those tools are used to produce components and parts), cutting tools are the primary consumable used in manufacturing, and their analysis of cutting tool consumption offers an indictor of overall activity in U.S. manufacturing. The CTMR is based on actual totals of reported by participating companies, and represents a majority of the domestic market for cutting tool products.

“The decline in May cutting tool shipments data is not surprising given the changing market, seasonal shutdowns and economic environment faced by our industry,” stated Brad Lawton, chairman of AMT’s Cutting Tool Product Group. “The monthly swings in shipments are consistent with expectations for a flat year relative to 2014.”

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.