The Japanese economy is heading for a slight downturn, and machine tool manufacturers are wary.

According to the JCER, the slowing of U.S. and Asian economies is ominous because exports served as "the engine of recovery" for previous downturns in the Japanese economy. It is also expected that GDP growth, which is estimated at 2.1% for the fiscal year 2000, should decline to 1.9% in fiscal 2001, with the slowdown hitting hardest in the second half of this year.

The most recent quarterly survey of the Japan Machine Tool Builders' Association (JMTBA) found member companies were aware of Japan's delicate economic condition. The survey indicated a "sensitivity and wariness of machine tool builders toward the out-look of the economy." Respondents expecting increasing orders for the January through March 2001 quarter totaled 25.4%. This was a 23.1-point drop compared to the last quarter's survey, when 48.5% felt orders would increase. Many of those previous optimists now anticipate sustained order levels, making the percentage of member companies predicting a plateau 61.2%. Those foreseeing decreased orders also increased by 6 points from 7.4 to 13.4%.

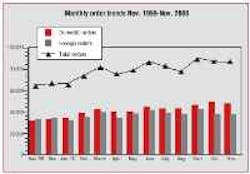

Japanese manufacturers are now seeing the effects of a recent slowing in monthly order rates. Things started out well in September 2000 with orders topping ¥90 billion for the first time in 27 months. This was an 11% increase from August's figures and good news for Japanese manufacturers. But the orders slowed, slipping 3.7% in October and then another 0.2% in November.

But year-to-year growth has remained solid throughout 2000. Total orders in the first 11 months of 2000 amounted to ¥887,786 million, up 28.6% from a year earlier with the rate of increase advancing 0.6 points over the year-on-year gain made in the first 10 months. By source, domestic orders accounted for ¥471,400 million, up 43.1%, and foreign orders for ¥416,386 million, up 15.4%, indicating robust trends.

During the 11-month period, domestic orders accounted for 56.4% of total orders as compared with 52.3% in the first 10 months. JMTBA believes this increase demonstrates the positive effect of the 20th JIMTOF exhibition, which took place from late October through early November.

According to the Japanese Ministry of Finance, total exports are up for the year 2000, with ¥529,222 in 1999 compared to a ¥560,658 total, from November 2000. Most of the exports, ¥198,159, are shipping to the U.S., followed by ¥71,130 worth of equipment to Taiwan and ¥32,486 to Germany. Imports are also on the rise, from ¥63,711 in 1999 to ¥72,264 as of November 2000. The U.S. is the major importer to Japan with ¥45,584, and Germany is next with ¥5,379, followed by Switzerland with ¥4,390.

| Value in million of Yen Exports by destination | ||||||

| *Country/Region | | | | | | |

| U.S. | ||||||

| Taiwan | | | | | | |

| Germany | ||||||

| China | | | | | | |

| Korea | ||||||

| Belgium | | | | | | |

| Italy | ||||||

| U.K. | | | | | | |

| Singapore | ||||||

| Thailand | | | | | | |

| Others | ||||||

| (EU) | | | | | | |

| Total | ||||||

| Source: Ministry of Finance *Order of top 10 destinations in 1999 | ||||||

| Value in million of Yen Imports by sources | ||||||

| | | |||||

| *Country/Region | | | | | | |

| U.S. | ||||||

| Germany | | | | | | |

| Switzerland | ||||||

| Thailand | | | | | | |

| China | ||||||

| Singapore | | | | | | |

| Taiwan | ||||||

| U.K. | | | | | | |

| Sweden | ||||||

| Korea | | | | | | |

| Others | ||||||

| (EU) | | | | | | |

| Total | ||||||

| Source: Ministry of Finance *Order of top 10 sources in 1999 | ||||||