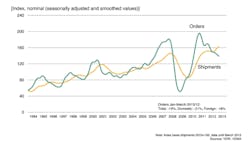

German machine tool builders’ new orders fell 19% year-on-year during the first quarter of 2013. The result, according to data reported by the Frankfurt-based German Machine Tool Builders’ Association (VDW), shows that domestic bookings for German machine tools continue to lag foreign orders, a situation that has troubled VDW members for much of the past year.

VDW reported domestic new orders were fell 21 percent during the first quarter, versus Q1 2012, and new orders from outside Germany dropped by 18 percent.

German machine tool builders are among the most important contributors to the global manufacturing technology industry, and within Germany machine tool manufacturing is a critical part of one the country’s most important industrial sectors, mechanical engineering. Thus, the unsteadiness in the European economy over the past year has put a strain on VDW members.

“Demand for machine tools is still lacking momentum,” noted Dr. Wilfried Schäfer, the trade group’s executive director.

He said a weak start to 2013 indicated “a perceptible degree of skepticism, not least by mid-tier customers in Germany.”

For example, new orders for metal cutting machinery — a product category that appeals across a broad range of manufacturing buyers — are down 26 percent versus the 2012 figure. However, demand for forming machinery — a line dominated by automotive industry manufacturers — shows no change from last year’s comparable figure.

“The year’s second half now has to provide a counterweight, if the predicted growth in production output of one percent is not to be put at risk,” according to Schäfer.

VDW indicated its members would concentrate on foreign deliveries to achieve growth targets. China is the member companies’ largest export market, and North American and Russian forecasts are also encouraging.

“There are also rays of hope from the international automotive industry,” according to the group’s statement, “which is deploying strategic investments in the battle for market shares, and from the aircraft industry and the mechanical engineering sector.”

In each of those markets, VDW noted, “above-average capital investments” are expected during 2013.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.