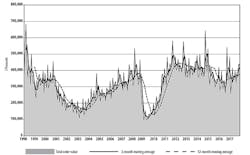

New U.S. orders for machine tools and related capital equipment continued strong during November 2017, at $425.97 million nationwide, yet that total slipped 3.5% below the October result. AMT – the Assn. for Manufacturing Technology, which reported the results in its monthly U.S. Manufacturing Technology Orders (USMTO) report, emphasized the ongoing manufacturing expansion evident in the improved year-over-year and year-to-date order volumes.

Compared to November 2016, the most recent new-orders volume represents an increase of 19.9%, and the January-November 2017 total represents an improvement of 9.4% over 2016.

AMT – the Assn. for Manufacturing Technology issues the USMTO report that summarizes actual totals for machine tool sales, nationwide and within six regions. The figures are reported by participating companies that produce and distribute metal-cutting and metal-forming and -fabricating equipment, including domestically manufactured and imported machinery and equipment.

The volume of new orders for manufacturing technology is a leading economic indicator of economic growth, according to AMT, as manufacturers in various industries invest in capital equipment as they anticipate near-term production increases.

The current demand for manufacturing technology also indicates other factors. “The new tax law is a big victory for manufacturers, who have been fighting for meaningful tax reform for decades,” commented AMT president Douglas K. Woods. “The lower rates together with expanded expensing provisions and a continued R&D tax credit will increase business confidence and investment at a time when transformative technologies are rapidly changing the landscape for our industry.”

The month-to-month decline in November new orders appeared to be concentrated in two regions of the U.S., the North Central-East and the South Central.

In the Northeast region, November manufacturing technology new orders totaled $67.62 million, 0.9% less than the October figure and 1.8% higher than the November 2016 figure. The YTD total for the region is $692.36 million, -3.6% compared to the 11-month result for 2016.

In the Southeast, new orders for metal-cutting equipment rose 8.0% from October and 35.5% from November 2016, with a regional total of $45.83 million. Total manufacturing technology new orders for the region through 11 months of 2017 were $486.5 million, which is 4.4% less than the comparable report for 2016.

In the North Central-East region, the November total for manufacturing technology orders was $15.08 million, a decline of 13.4% from October but still 23.8% higher than the November 2016 result. Through 11 months of 2017, the region’s total new orders stood at $1.016 billion, 11.1% higher than the year-earlier figure.

The North Central-West region’s manufacturers ordered $92.98 million worth of manufacturing technology during November 2017, 9.2% more than October and 2.7% more than November 2016. For the year-to-date, the region reported manufacturing technology orders totaling $769.34 million, or 10.1% more than the 2016 comparison.

In the South-Central region, new orders for metal-cutting equipment fell 21.2% from October to $33.84 million during November. That figure is still 74.8% higher than the November 2016 regional total, indicating the revived fortunes of manufacturers serving the oil-and-gas sector. Through the first 11 months of 2017, the South-Central region posted total manufacturing technology new orders valued at $378.56 million, or 63.8% higher than the comparable total for 2016.

Finally, in the West region new orders for metal-cutting machinery rose to $70.17 million during November, 6.0% higher than October and 31.2% higher than November 2016. For the year-to-date, the region’s total manufacturing technology orders had risen to $714.98 million, a 12.3% improvement over 2016.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.