Manufacturers’ Cutting Tool Consumption Off-Pace in October

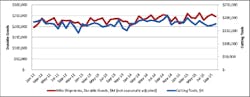

U.S. manufacturers consumed $177.2 million worth of cutting tools during October, the total rising 3.4% above the September result, ending a three-month decline for an index that closely tracks overall manufacturing activity. However, the latest figure remains 15.4% behind the level recorded for last October.

The new result also means the 10-month total for 2015 cutting-tool consumption is 3.4% behind the pace set in 2014.

The monthly Cutting Tool Market Report (CTMR) is presented jointly by the U.S. Cutting Tool Institute (USCTI) and AMT - the Association for Manufacturing Technology, which track consumption of cutting tools as an indicator of manufacturing activity in the U.S.

CTMR data is based on actual totals reported by participating companies, who the sponsors note represent the majority of the U.S. market for cutting tools.

The sponsors maintain that cutting tools are “the primary consumable in the manufacturing process,” and that cutting tool consumption “is a true measure of actual production levels.” By contrast, the monthly U.S. Manufacturing Technology Orders report presented monthly by AMT measures new orders for machine tools as an indicator of manufacturers’ confidence in the future business cycle.

“The information from October continues to be the same story for the cutting tool market,” USCTI president Steve Stokey observed of the latest results.

“We see a slight uptick in October over September which was to be expected. Our year over year data continues to weaken due to the strong finish of 2014 and a weak 2015,” he said. “Members continue to be optimistic about aerospace and automotive markets but see no short to mid-term improvement in the oil and gas industry for their products.”

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.