Global Steel Demand Forecast to Grow, but Slowly

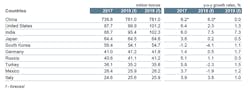

The World Steel Assn. forecasts global steel demand will total 1.66 billion metric tons for 2018, 3.9% higher than 2017, and that 2019 demand will rise a further 1.4% to 1.68 billion metric tons. The figures are provided by World Steel’s Economics Committee, which issued its semi-annual Short-Range Outlook report for 2018. The current report signals that demand for steel has expanded by 41.8 million metric tons since the last SRO issued in April, and it sees 2019 demand increasing by 54.5 million metric tons over the previous forecast.

Al Remeithi, chairman of the World Steel Economics Committee, said: “In 2018, global steel demand continued to show resilience supported by the recovery in investment activities in developed economies and the improved performance of emerging economies.

“Demand for steel is expected to remain positive into 2019, growing at 1.4% globally,” he added.

The forecasters commented that risks to demand growth have increased, too, citing trade tensions and currency volatility. Normalization of monetary policies in the U.S. and EU could adversely affect the currencies in emerging economies, they noted.

Steel demand in China has strengthened in 2018 thanks to a real-estate stimulus and a strong global economy. However, ongoing efforts to rebalance the Chinese economy and to enforce environmental regulations will lead to weaker steel demand in the latter half of 2018 and into 2019.

Trade tensions with the U.S. represent a risk to steel demand in China, as does decelerating global economic growth.

Steel demand in the U.S. has been growing since 2017, benefitting from strong consumer and business spending, and supported by tax and regulatory changes as well as fiscal stimulus. Lately, however, the U.S. construction sector has moderated, and U.S. steel demand growth in is expected to slow in 2019 as automotive product and construction activity grow more moderately.

U.S. manufacturing is expected to perform well, thanks to continued strong demand for industrial machinery and capital equipment.

EU steel demand is expected to continue expanding, though at a slower pace and guided mainly by domestic demand, and that rate will decelerate in 2019. Again, global trade issues pose a notable risk to demand expansion in Europe.

Japanese steel demand is strong and steady, though Korean steel demand is contracting, according to the Outlook.

Construction demand for steel products is likely to moderate in the world’s developed economies, following significant growth in 2017-18. Rising interest rates also present a risk to construction spending. Construction activity in the developing regions (India, S.E. Asia, and Middle East/Africa) is forecast to grow, with the exception of Brazil.

Automotive-sector demand for steel products is weakening in developed regions, as automotive consumer demand, rising fuel costs, and rising interest rates affect automaking activity. In developing markets, demand for new cars is forecast to continue expanding.