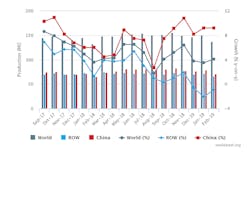

Global raw-steel production totaled 137.3 million during February, declining -8.7% from January but 4.1% higher than the February 2018 total. For the first two months of the current year, global raw-steel production is 3.76% higher than the comparable 2018 result.

While the results show the effects of industrial slowing in most regions — notably excluding China and the U.S. — the figures are in line with the "slow-but-steady growth" forecast by the World Steel Assn. in its late-2018 market forecast. World Steel’s monthly raw-steel production report presents output from about 99% of the world’s installed capacity.

Raw steel is produced in basic-oxygen and electric-arc furnaces, and cast into semi-finished products, like billets, blooms, and slabs. Most raw steel is produced on contract for large manufacturers, like automotive, appliance, and machinery builders. Less predictable is the amount produced for construction markets or for service centers and distributors.

The global steel market is dominated by China’s industry, which represents roughly half of the world’s total installed capacity. In February, Chinese producers’ output rose 9.2% from January to 137.3 million metric tons, slightly more than 51% of the global total. The Chinese output represents a 9.2% rise over the February 2018 result, as well as a 9.2% improvement in the YTD total.

Elsewhere in the Asian region, Indian raw-steel production fell -4.9% month/month to 8.74 million metric tons, but rose 2.26% year/year and remained roughly even (+0.12%) YTD. Japanese production totaled 7.7 million metric tons, -4.9% month/month, -6.65% year/year, and -8.3% YTD. South Korean production fell to 5.5 million metric tons, -14.2% month/month, but up 1.0% year/year and 1.1% YTD.

February raw-steel production in the European Union (28 nations) totaled 13.0 million metric tons, -6.5% less than in January, -5.0% less than in February 2018, and bringing the 2019 YTD total -3.9% less than the January-February 2018 result.

Within the EU, German raw-steel production of 3.45 million metric tons fell -9.7% month/month, -9.35% year/year, and -7.63% YTD.

Italian raw-steel production rose 4.4% from January to February, to 1.95 million metric tons; that represents a -2.7% year/year drop, and a -3.15% decline YTD. Steelmakers in France produced 1.2 million metric tons in February, up 0.8% month/month but down -0.25% year/year and -5.2% YTD. Spain’s February raw-steel output was 1.1 million metric tons, -3.8% month/month but up 2.5% year/year and 4.2% YTD.

Elsewhere, Russian steelmakers’ February output was 5.2 million metric tons, down -9.67% month/month, -4.4% year/year, and -4.5% YTD. In the Ukraine, February raw-steel production of 1.7 million metric tons represented a decline of -8.7% month/month but a 5.0% year/year improvement. The YTD results are nearly even.

Turkish steelmakers produced 2.6 million metric tons during February; 2.6% higher month/month, but -12.5% lower year/year and -16.1% YTD.

Brazil’s industry produced 2.66 million metric tons of raw steel during February, -9.3% month/month and -1.7% year/year, but nearly even YTD.

Finally, U.S. raw-steel production during February fell -8.3% from January to 6.9 million metric tons (7.6 million short tons), but that figure is 4.6% higher than the February 2018 result. For the current year, U.S. producers’ output total 14.4 million metric tons ( 15.9 million short tons, a 6.9% year-to-date improvement.