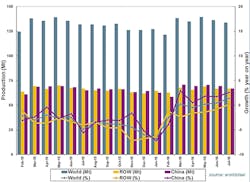

Global raw steel production totaled 133.7 million metric tons during July, according to the World Steel Assn., 1.8% less than the June tonnage and 1.36% less than the July 2015 figure. Through seven months of activity for 2016, steelmakers worldwide have produced 929.6 million metric tons or raw steel, which is just 1.24% off the pace set during 2015.

Also during July, the global raw-steel capacity utilization rate was 68.3%, down 3.7% from June but unchanged from July 2015.

Raw steel is the output of basic oxygen furnaces and electric arc furnaces that is cast into semi-finished products, such as slabs, blooms, or billets. The World Steel Association reports tonnage and capacity utilization data for carbon and carbon alloy steel in 66 countries; data for production of stainless and specialty alloy steels are not included.

Last spring, World Steel issued an outlook report suggesting final 2016 tonnage would show a year-on-year (-0.8%) decline in global steel demand, to an estimated 1.488 billion metric tons, following the -3.0% annual decline in the 2015 global steel production (1.62 billion metric tons.)

The decline in tonnage documents steelmakers’ efforts to adjust their output and inventories to their local and regional demand, the circumstances in the largest steelmaking nation are more complex: while that industry is by far the world’s largest, Chinese central planners are implementing a strategy of eliminating excess capacity and consolidating organizational control over the nation’s largest producers.

China’s raw steel production fell 3.83% from June to July 2016, with a monthly total of 66.8 million metric tons. That figure, however 2.6% higher than the July 2015 result, and brings the Chinese steelmakers’ year-to-date raw steel production total to 466.5 million metric tons, down 0.5% compare to 2015’s January-July report.

In Japan, steelmakers produced 8.9 million metric tons of raw steel during July 2016, 1.32% more than in June and 0.5% more than in July 2015. For the year-to-date, the Japanese industry has produced 60.9 million metric tons, a decline of 0.83% from the comparable 2015 figure.

Indian steelmakers produced 8.1 million metric tons of raw steel during July 2016, 0.57% more than during June but 8.1% more than the July 2015 total. That industry has increased its year-to-date tonnage by 4.84% over last year’s total.

The South Korean steel industry produced 6.0 million metric tons of raw steel production was 6.0 million metric tons in July 2016, up by 1.5% on July 2015.

Steelmakers across the European Union (28 nations) produced 12.98 million metric tons during July, 5.51% less than during June and 4.58% less than during July 2015. The seven-month total is 95.7 million metric tons, 5.83% less than Jan.-July 2015 total.

German steelmakers, the largest steelmaking industry within the E.U., produced 3.4 million metric tons of raw steel during July 2016, 7.45% less than during June 6.1% less than during July 2015. Compared to 2015’s seven-month total, the German industry is 1.99% off the pace.

Elsewhere, the Italian steelmakers produced 2.05 million metric tons during July, up just 0.84% over June but 6.17% higher than during July 2015. Italy’s YTD total is 14.18 million metric tons, 2.88% higher than 2015’s comparable total.

French steelmakers produced 1.15 million metric tons last month, 12.1% less than during June and 4.7% less than during July 2015. Their seven-month total is 8.37 million metric tons, 10.6% less than the 2015 figure.

In Spain, steelmakers’ July tonnage totaled just 840,000 metric ton, which was 25.5% less than during June and 13.01% less than during July 2015. Their January-June total is 8.17 million metric tons, or 7.95% less than the comparable 2015 figure.

Turkish steelmakers produce 2.7 million metric tons during July, down 7.16% from June and but up 6.47% over last July’s report, and the seven-month total of 19.15 million metric tons is 3.6% more than last year’s total

During July Russian steelmakers produced 6.1 million metric tons of raw steel, 4.44% more than during the previous month and 0.9% more than during July 2015. Their year-to-date output now stands at 41.4 million metric tons, 0.81% less than they had produced last year at the comparable point.

Steelmakers in Ukraine produced 2.1 million metric tons of raw steel during July, 12.82% more than during June and 10.5% more than during July 2015. For the current year, they have produced 14.47 million metric tons or raw steel, 10.3% more than at the same point of 2015.

Brazil’s steelmakers’ July output totaled 2.7 million metric tons, just 0.78% more than during June and 2.2% less than during July 2015. The year-to-date raw steel production in Brazil is 17.57 million metric tons, which is 11.98% less than last year’s comparable figure.

The United States steel industry produced 6.9 million metric tons (7.6 million short tons) of raw steel during July, 0.78% more than during June and 2.2% less than during July 2015. The U.S. industry’s January-June tonnage totals 46.9 million metric tons, just 0.17% less than the tonnage at the same point of 2015.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.