Adverse Trend Continues for Machine Tool Demand

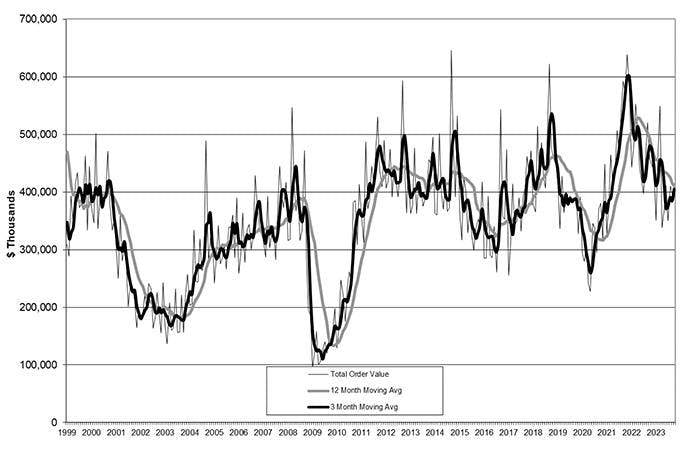

U.S. machine shops’ and other manufacturers’ new orders for capital equipment increased to $409.7 million during October, up 4.0% from September, though the new result is a -10.6% drop from the October 2022 total. More concerning is that the 10-month total value for new orders is now $4.05 billion, -13.5% less than last year’s comparable 10-month result.

The figures are provided by AMT - the Assn. for Manufacturing Technology in its latest U.S. Technology Orders Report. The USMTO program reports new orders as an indicator of future manufacturing activity, as machining operations prepare to undertake new production programs. The monthly update tracks orders for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

Noting the diminishing number of economic forecasts for a U.S. recession, pointed out that the improved October result was centered in West (+58.8% from September), Southeast (44.6%), and South Central (+14.1%) regions; the other three regions all posted month-to-month declines, and one of those (North Central-West, -29.6%) reported a more significant decrease in order totals.

AMT identified the conclusion of the United Autoworkers union strike in October as one cause for the improvement, as automakers and their suppliers continued to invest in new manufacturing technology.

Another notable aspect of the October results is that machining job shops decreased the value of their orders during the month, although the number of units purchased rose from September. In contrast, “OEMs have been increasing order value at a faster pace than units,” according to AMT’s announcement, “suggesting that they are purchasing machinery for a designated purpose. Of these OEMs, manufacturers of household and major appliance manufacturers made their largest investment since September 2018.”

Manufacturers of power transmission equipment – engines, turbines, and other parts – continued to post strong rates of investment during October, with orders 8.0% now ahead of the 2022 rate. “This sector is benefiting from recent government investment, pushing orders of manufacturing technology to levels not seen since the industry was transitioning from coal-fired plants to natural gas,” according to AMT.