Machine-Tool Orders Show Manufacturing is Slowing

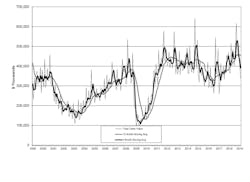

U.S. manufacturers’ capital investments in machine tools ("manufacturing technology") rose to $413.7 million during March, up 26.6% from February and yet down -18.4% versus the March 2018 result. AMT – the Assn. for Manufacturing Technology, the figures indicate that manufacturing "growth is beginning to slow."

The March result reverses a five-month trend of declining new orders for manufacturing technology, but AMT noted the data may be signaling a different development. Through the first three months of 2019, new orders have totaled $1.13 billion, down -9.5% versus the comparable January-March period of 2018.

Actual manufacturing activity remains strong, as indicated in the monthly Cutting Tool Market Report: Domestic manufacturers’ cutting-tool purchases rose to $210.4 million during March, +1.6% year-over-year and +8.6% year-to-date.

AMT issues the monthly U.S. Manufacturing Technology Orders report, which records new orders for metal cutting and metal forming and fabricating equipment as a leading indicator of industrial activity. The USMTO report is based on data supplied by participating producers and distributors of metal-cutting and metal-forming and -fabricating equipment, and offers a leading indicator of industrial demand as machine shops and other manufacturers invest to complete planned or anticipated production programs.

“The 2019 market for manufacturing technology will contract from 2018 but will still likely be one of the best years since the Great Recession,” stated Pat McGibbon, AMT chief knowledge officer. “Growth expectations in key geographic markets like China, Europe and a continued rapid expansion in India could lead to any downturn being one of the shortest on record for the manufacturing technology sector.”

AMT noted that most of the major customer segments for component parts delivered double-digit increases from February to March – though the automotive market was an exception.

Engine and turbine customers’ orders more than doubled from February, AMT noted, and new orders for job shops increased nearly 15% from the previous month.

The looming issue of a "trade war with China" makes the manufacturing market difficult to forecast, according to AMT.

”Tariffs run counter to our global competitiveness as they negatively impact not only the offending country but also U.S. companies and their customers,” McGibbon stated. “AMT members are working hard to mitigate increased costs and minimize risks to revenue while providing the leading-edge technology that will foster productivity growth.”

The USMTO report includes the new-order totals from six regions of the U.S. economy, and the March results indicate comparative strength in the Northeast and Southeast.

The Northeast region is comparatively strong with new orders totaling $80.44 million during March, 32.4% more than the February result and 3.2% more than the March 2018. For the year-to-date, however, Northeast regional new orders are practically even ($216.7 million, +0.8%) with January-March 2019.

The Southeast region reported March new orders for metal-cutting machinery totaling $59.12 million, a 68.5% improvement over February but a -1.4% drop from March 2019. The Southeast regional year-to-date metal-cutting machinery orders are up 17.6% to $147.9 million.

In the North Central-East, total manufacturing technology orders rose to $101.04 million during March, up 60.5% from February but down -1.2% from March 2018. The three-month total for 2019 new orders is $249.96 million, a drop of -9.7% year-over-year.

The North Central-West region reported March metal-cutting machinery orders of $67.41 million, up 6.1% from February and down -33.8% from March 2018. For the year-to-date, the region’s metal-cutting machinery orders are down -12.2%, to $200.85 million.

The South Central region reported new orders for metal-cutting machinery totaling $35.66 million during March, up 23.6% from February and down -33.1% from March 2018. Through three months, the regional total for new orders of metal-cutting machinery stands at $97.57 million, a -31.8% drop.

Lastly, the West region’s new-order total for metal-cutting machinery during March is $63.74 million, a -10.3% decline from February and a -38.5% drop from March 2019. The year-to-date total for metal-cutting machinery orders in the region is $197.24 million, a -13.0% year-over-year decline.