Chinese Machine Builders Fighting Weak Demand

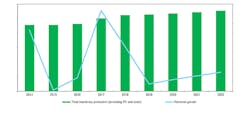

Weak demand is affecting 2019 revenues for China’s industrial machinery manufacturers, according to a new report issued by IHS Markit. The 2019 revenue forecast for the manufacturers is just 0.8%, which would indicate the lowest growth rate for the sector since 2015.

The IHS Markit Automation and Machinery Production Report - China covers Chinese economic indices, capital expenditures, machinery production, and the industrial automation equipment sales outlook. The report illustrates overall machinery production and industrial automation product market trends in mainland China, and provides a five-year revenue forecast.

China’s machinery market is being impacted by a general slowdown in the domestic economy, with numerous downstream industries reporting decelerating demand, including automotive manufacturing.

In addition, offshore industrial demand is declining, in part due to uncertainties surrounding global trade, impacting machinery exports.

The IHS report also noted that production of high-value machinery in some industrial segments continues to be dominated by foreign manufacturers, and the comparable Chinese domestic manufacturers have yet to develop the proficiency to serve this demand.

Despite this, there are also some signs indicating that equipment replacement is helping to offset some of the downward pressure on machinery production in 2019.

In the agricultural equipment market, Chinese domestic demand has not yet overcome the setback that started in 2014. In 2019, a new implementation phase for China’s National IV emissions standard is scheduled for December 1, 2020, which may affect agricultural machinery production in short term.

National IV compliance also may increase the cost of agricultural machinery, which would depress purchase volumes.

A large-scale reduction in rice planning also will negatively affect demand for agricultural machinery, according to IHS.

Construction machinery faces some similar challenges in regard to the National IV emission standards implementation.

Some construction machinery demand may be driven by inventory updates, and infrastructure spending continues to be have a positive effect on China’s domestic suppliers.