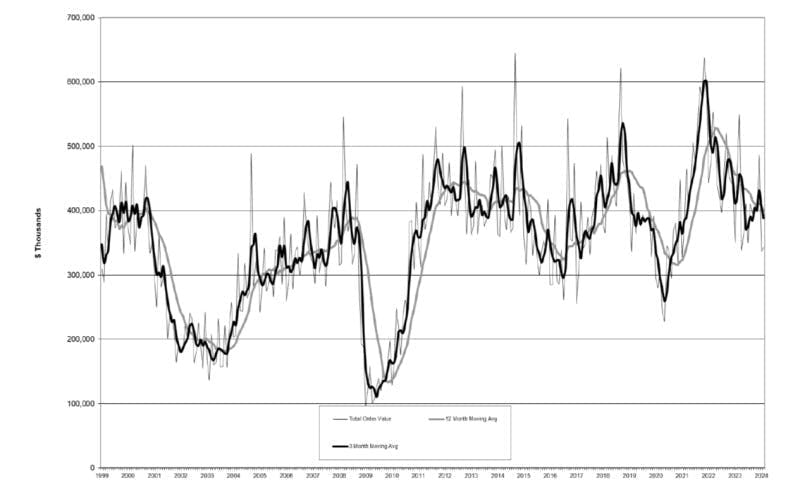

U.S. machine shops and other operators of machining and cutting technology purchased $343.3 million worth of new capital equipment during February, +2.1% more than during January but well below (-26.5%) the total for February 2023. Interestingly, the number of units sold fell from 1,572 machines for January to 1,480 ordered during February.

The improvement is in line with the Institute for Supply Management’s latest monthly Purchasing Managers’ Index, which measures orders of a wide variety of goods as an indicator of manufacturing sector growth. The March PMI report showed that the manufacturing sector expanded for the first time in 17 months, since September 2022.

The two-month total for 2024 U.S. manufacturing technology orders is $679.6 million, which is -16.9% lower than last year’s January-February result.

The figures are supplied by AMT - the Assn. for Manufacturing Technology in its latest U.S. Manufacturing Technology Orders report. USMTO is a monthly review of new orders for machine tools, and it serves as an indicator of future manufacturing activity because it quantifies machining operations’ investments in preparation for new production programs. AMT’s monthly update compiles data for metal-cutting and metal-forming-and-fabricating machinery, nationwide and in six regions of the U.S.

AMT acknowledged that 2024 orders are below forecast expectations, but also appear weak in comparison to the very strong level of activity during Q1 2023. That three-month period last year was followed by wavering demand for new manufacturing technology, a trend that is continuing now.

Of note, AMT pointed to continuing decreased order volumes from contract machining operations (job shops), which represent the largest segment of the market for manufacturing technology. February marked only the second time since September 2021 for those buyers to decrease their orders while overall activity was increasing.

Meanwhile, larger manufacturing businesses in market segments like the aerospace and energy sectors have continued to increase their capital investments.

For example, manufacturers of turbines and power transmission equipment increased their order value to their highest level since February 2023. According to AMT, this is prompted by investments in infrastructure to improve electrical grid performance.

Aerospace manufacturing is another area of improvement for manufacturing technology orders, delivering the second-highest total for the sector since December 2022, with activity involving both commercial and defense aviation programs.

Regionally, the February new-order activity was strongest in the South Central (+24.6% over January) and West (+17.8%) regions. For year-over-year results, the Southeast scored a +39.7% improvement over February 2023 order volume, while the West region was +14.9% over last February. Other regions posted double-digit year-over-year order decreases.

To look ahead, AMT advised that March may be a sign of things to come as the month represents the end of a fiscal year for some businesses, and thus may deliver some new order activity. However, as March 2023 order activity was fairly strong ($548.8 million), a year-over-year improvement may be a high bar even amid other signs of improving manufacturing activity.

This is article is revised from an earlier published draft.