Machine Tool Orders Fell Over 20% in October

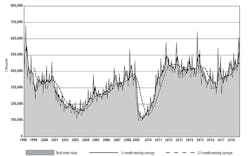

U.S. manufacturers placed $467 million worth of new orders for machine tools and related capital equipment during October, a 23.3% drop from the September new-order total, but still 2.1% higher than the October 2017 total. The decline during October represents the sixth monthly decrease during 2018, but it may have been anticipated due to the staging of IMTS 2018 during September. It’s also notable that the year-to-date total for new machine-tool orders is now $4.54 billion, an increase of 23.6% versus the 10-month total for 2017.

Still, the German Machine Tool Builders Assn. reported recently that despite a 7% rise in year-over-year new orders, reduced demand during the 3Q 2018 is attributable to a slowing global economy resulting from trade conflicts, increasing protectionism, rising oil prices, high inflation in various emerging markets, and unchecked debt.

All of the figures for domestic machine orders are supplied by the U.S. Manufacturing Technology Orders report, a monthly summary compiled and issued by AMT – the Assn. for Manufacturing Technology and based on data supplied by participating producers and distributors of metal-cutting and metal-forming and -fabricating equipment. The USMTO report includes data for domestically manufactured and imported machinery and equipment, and the results are based on actual order totals, nationwide and in six regional markets.

“IMTS always creates a September jump in orders but the strength of October and August punctuates that the market is buying for current capacity need, not speculation on future business,” observed AMT president Doug Woods. “Right now, manufacturing technology orders are rapidly expanding without apparent concern for trade issues or evolving market conditions because our customers face enormous opportunities now.”

As evidence, AMT noted that several economic indicators remain strong, including durable goods orders, consumer confidence indices, and the ISM Purchasing Managers’ Index, all of which suggest continued growth in manufacturing at slower rates.

USMTO’s October regional reports reflected the overall trend of month-to-month decline but year-to-date expansion. In the Northeast region, total new orders for manufacturing technology decline 26.6% from September to $86.36 million, though that figure is 21.1% higher than the comparable figure for October 2017. The regional 10-month total for metal-cutting equipment orders is $792.5 million, up 29.2% over last year’s figure.

In the Southeast region, new orders for metal-cutting equipment totaled $75.8 million for October, 39.0% lower than in September but 62.4% higher than in October 2017. The YTD result is $559.17 million, a 35.3% rise over last year.

In the North Central-East region, total orders for October fell 14.3% from September to $103.17 million, and that also represented a decline of 16.9% from October 2017. The regional year-to-date new order total is up 11.5% over 2017, at $1.02 billion.

The North Central-West region had total manufacturing technology orders of $79.8 million during October, down 25.2% from September and down 10.3% from October 2017. Even so, the regional YTD result is up 36.2% versus January-October 2017.

The South Central region reported October new orders for metal-cutting equipment worth $34.33 million, a decline of 22.3% from September and of 21.3% from October 2017. Again, however, the year-to-date total for new orders in the region at up 26.2%.

Finally, in the West region, October new orders for metal-cutting equipment fell 8.3% from the previous month to $82.26 million, which is 9.4% higher than last year’s comparable figure. The region’s year-to-date total for all manufacturing technology is up to $753.8 million, a rise of 17.5% YTD.