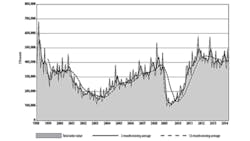

New orders for machine tools and related products totaled $391.53 million during April, a drop of 20.4% from March’s revised result, but a 9.8% improvement over the April 2013 total. Still, the latest data brings the January-to-April total for manufacturing technology orders to $1.62 billion, a 3.0% rise over new orders for the comparable period of 2013.

The figures are contained in the latest U.S. Manufacturing Technology Orders report, a monthly report by AMT – the Association for Manufacturing Technology. The USMTO covers nationwide orders for metal-cutting equipment separately from metal forming and fabricating equipment, both domestically sourced and import products, with the combined figure representing the monthly total. Results are provided for six geographic regions as well the U.S. total results.

“The manufacturing technology market is up 3% year-over-year thanks to March and April orders picking up the slack from the January and February weather-induced slowdown,” according to AMT president Douglas K. Woods.

“Indicators such as the Purchasing Managers’ Index, which surged forward in May and the optimism expressed by Oxford Economics in their spring update on our market, suggest we are on track for strong 2014,” Woods observed.

AMT tracks new orders in six regions, though adjustments to the survey participants over the past year mean that the year-over-year comparison for Metal Forming and Fabricating is not accurate across all regions.

Wide Variance in Regional Results

The Association reported that new orders in the Northeast totaled $62.72 million during April, declining 6.9% from March and 10.6% from the April 2013 result. For the year-to-date, Northeastern new orders for metal cutting machinery have risen 14.1%, year-on-year, and stand at $270.56 million.

In the Southeast, new orders for metal cutting machinery rose 16.2% from March to April, to $44.01 million. The new figure also is 35.9% higher than the April 2014 total. For the January-April period, manufacturing technology orders in the Southeast totaled $150.47 million, 16.6% higher than during the comparable period of 2013.

The North Central-East regional results for April show manufacturing technology new orders declined 50.3% during April, down to $99.57 million from $200.41 million during March. Still, the current figure is a 47.4% increase compared to the April 2013 result.

At $470.74 million, the North Central-East region’s year-to-date 2014 total is up 11.9% over the same period of 2013.

In the North Central-West region, April manufacturing technology orders totaled $64.90 million, declining 7.3% from the March result, but rising 4.7% from the April 2013 total. The January-April 2014 total is $236.12 million, a 4.4% decline from the comparable figure for 2013.

The South Central region’s new orders for metal cutting machinery declined 1.4% during April, falling to $61.20 million. That result is up 4.5% over the April 2013 figure. For the year-to-date, the region’s new orders total $236.12 million, down 4.4% over the same four-month period of 2013.

Finally, in the West region, March new orders for metal cutting machinery rose 6.2% from March to $56.56 million, though that figure was down 5.9% from April 2013 results. For the January-April period, the West’s new orders for metal cutting machines now stand at $237.59 million, a 5.3% rise over the comparable four months of 2013.

About the Author

Robert Brooks

Content Director

Robert Brooks has been a business-to-business reporter, writer, editor, and columnist for more than 20 years, specializing in the primary metal and basic manufacturing industries.